From Dot-Com to Crypto: Why Only a Few Blue Chips Will Win Big

History Doesn’t Repeat, But It Rhymes

In the late 1990s, the internet seduced the world. Money flowed into startups with slick websites but no working product. Everyone believed they were early to the “next big thing.” For a while, they were. Until reality hit.

The dot-com bubble burst in 2000, vaporizing over $5 trillion in market cap. But the internet didn’t die — it matured.

And the few companies that survived?

They became the foundation of a new digital era.

Today, crypto is walking a similar path.

The Dot-Com Boom: Speculation vs. Survival

Investors during the dot-com era bought into the idea of the internet, not necessarily the businesses being built. The problem wasn’t the tech — it was the mismatch between short-term expectations and long-term infrastructure development.

Most companies failed. A handful thrived.

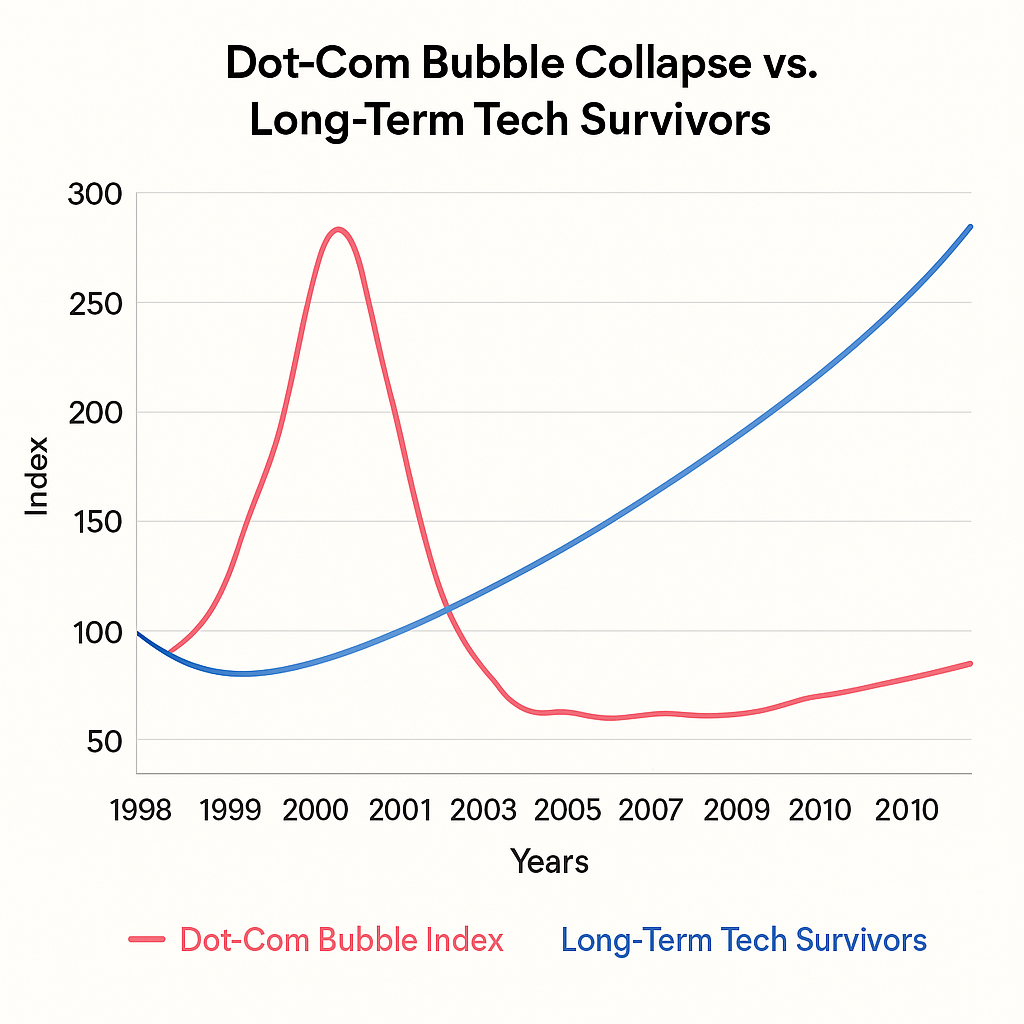

Dot-Com Bubble Collapse vs. Long-Term Tech Survivors (1998–2010)

This chart contrasts the Nasdaq Composite crash with the long-term growth of key survivors. It visualizes how value consolidation occurred after the bubble.

Crypto: A Familiar Frenzy

Crypto today is full of bold claims, trillion-dollar valuations, and aggressive marketing. Sound familiar?

We’ve seen the rise of tokenized assets, decentralized finance, digital identity, NFT’s, and payment protocols — but also thousands of copy-paste projects with no clear use case.

Most won’t make it. But the underlying technology is here to stay.

And just like the early internet, it’s not about who shouts the loudest — it’s about who builds the rails of the next financial system.

The Anatomy of a Blue Chip: What Makes One Last

In both the dot-com and crypto eras, durability comes down to core principles:

• Real-World Utility

If it doesn’t solve a real problem, it won’t survive. The winners will be used daily by people, businesses, or machines.

• Scalability

Can the network grow without breaking? Is it designed to handle global adoption?

• Security & Trust

Blue-chip protocols must be resilient against attack and manipulation. This earns user trust over time.

• Ecosystem Support

Survivors are rarely alone. They have developers, integrations, partnerships, and liquidity.

• Regulatory Alignment

The future will be compliant. Projects that proactively align with regulation will outlive those that fight it.

• Network Effects

The more a protocol is used, the stronger it gets. This compounding advantage separates long-term winners from the rest.

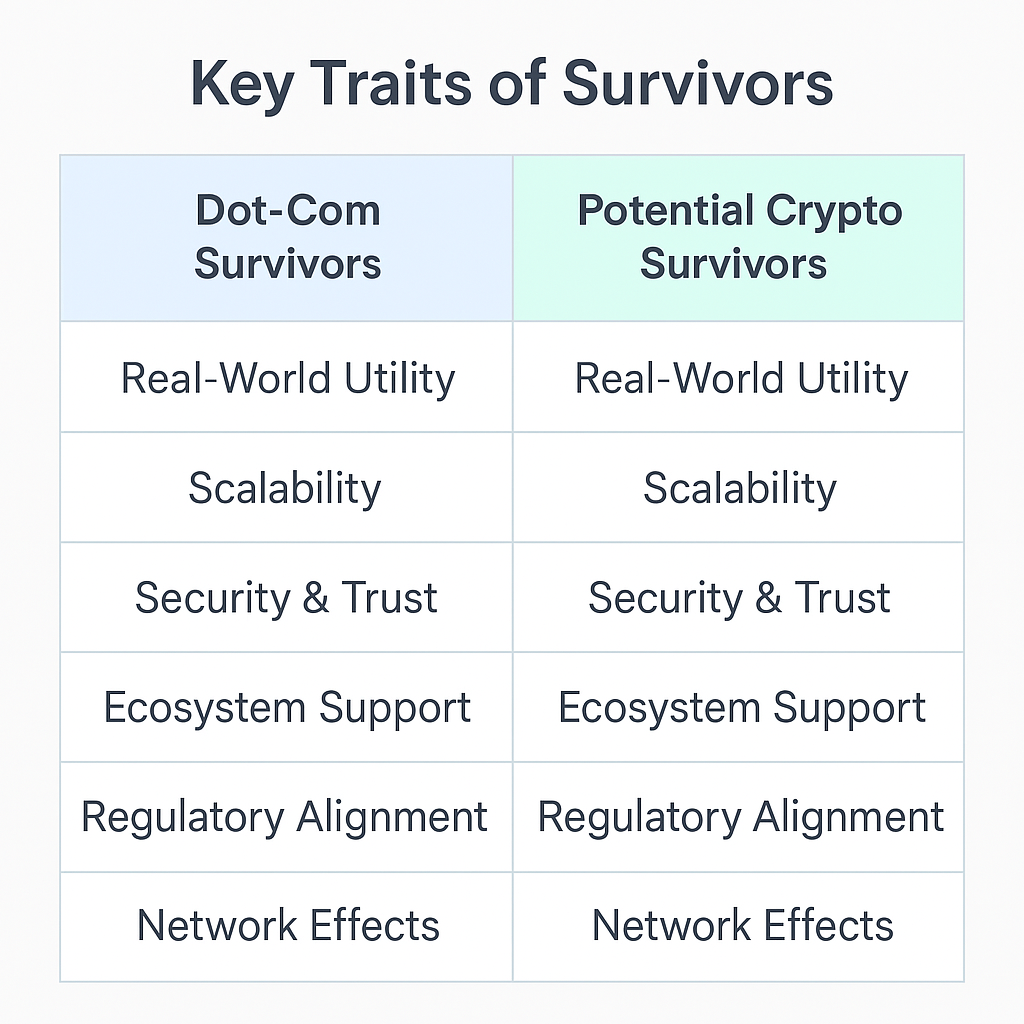

Key Traits of Survivors: Dot-Com vs. Crypto Comparison

A side-by-side table showing which traits helped internet companies thrive — and which traits crypto projects need to mirror to do the same.

What the Dot-Com Crash Taught Us About Patience

In 2001, the internet looked like a failed experiment. But behind the scenes, infrastructure was still being built. Fiber optics expanded. Programming languages improved. Payment rails emerged. The world just needed time to catch up.

Crypto is no different. Despite volatility, key protocols are laying the groundwork for tokenized finance, decentralized data, and programmable money.

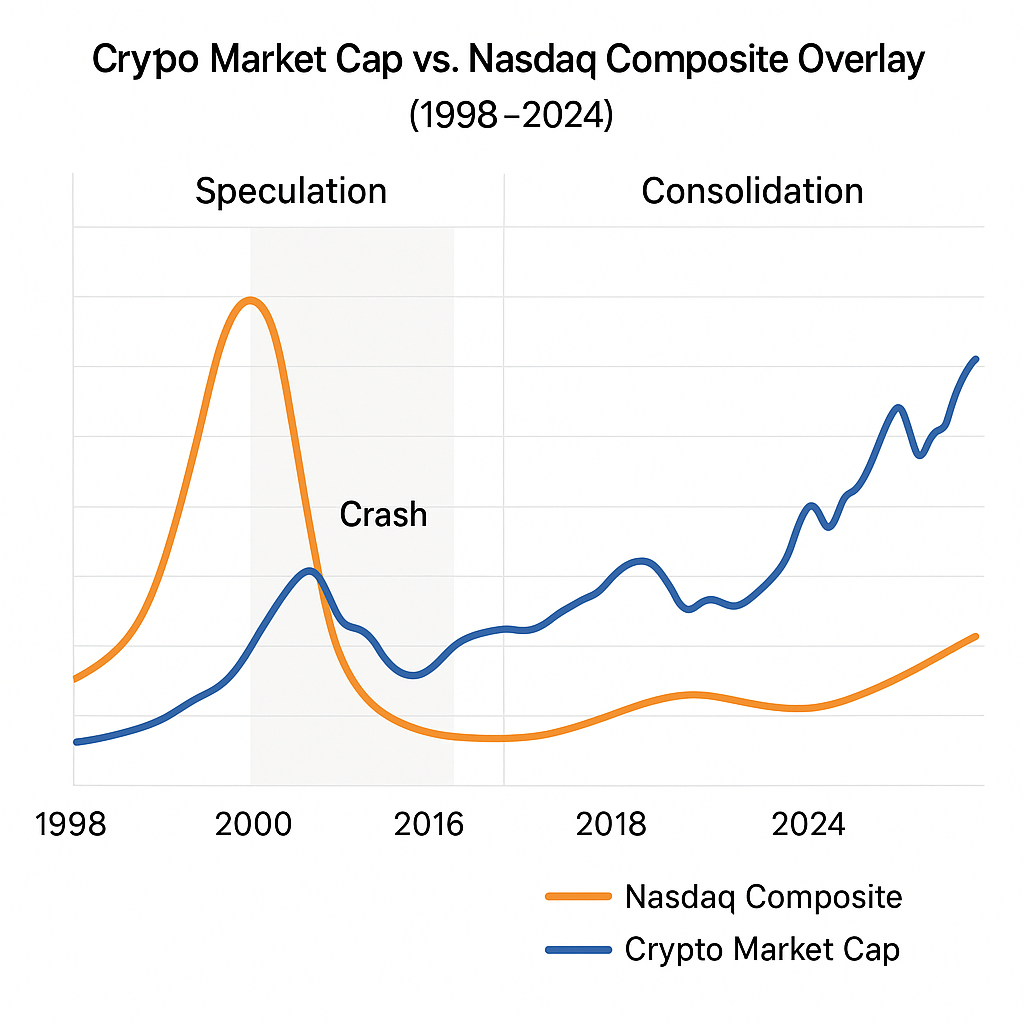

Crypto Market Cap vs. Nasdaq Composite Overlay (1998–2024)

A visual comparison of market cycle patterns — emphasizing the shape of bubbles and the consolidation that follows.

The Bayberry Capital Strategy: Don’t Chase — Understand

We don’t chase pumps. We don’t speculate on hype. We look for deep asymmetric opportunities — assets where long-term value is not yet priced in.

The question we ask is not “What’s going up?”

It’s “What will still be standing in ten years?”

We look for:

• Infrastructure-level protocols

• Real-world application

• Aligned incentives between users, builders, and investors

• Market inefficiencies that others overlook

It’s not about finding the next fad — it’s about identifying digital infrastructure before it becomes obvious.

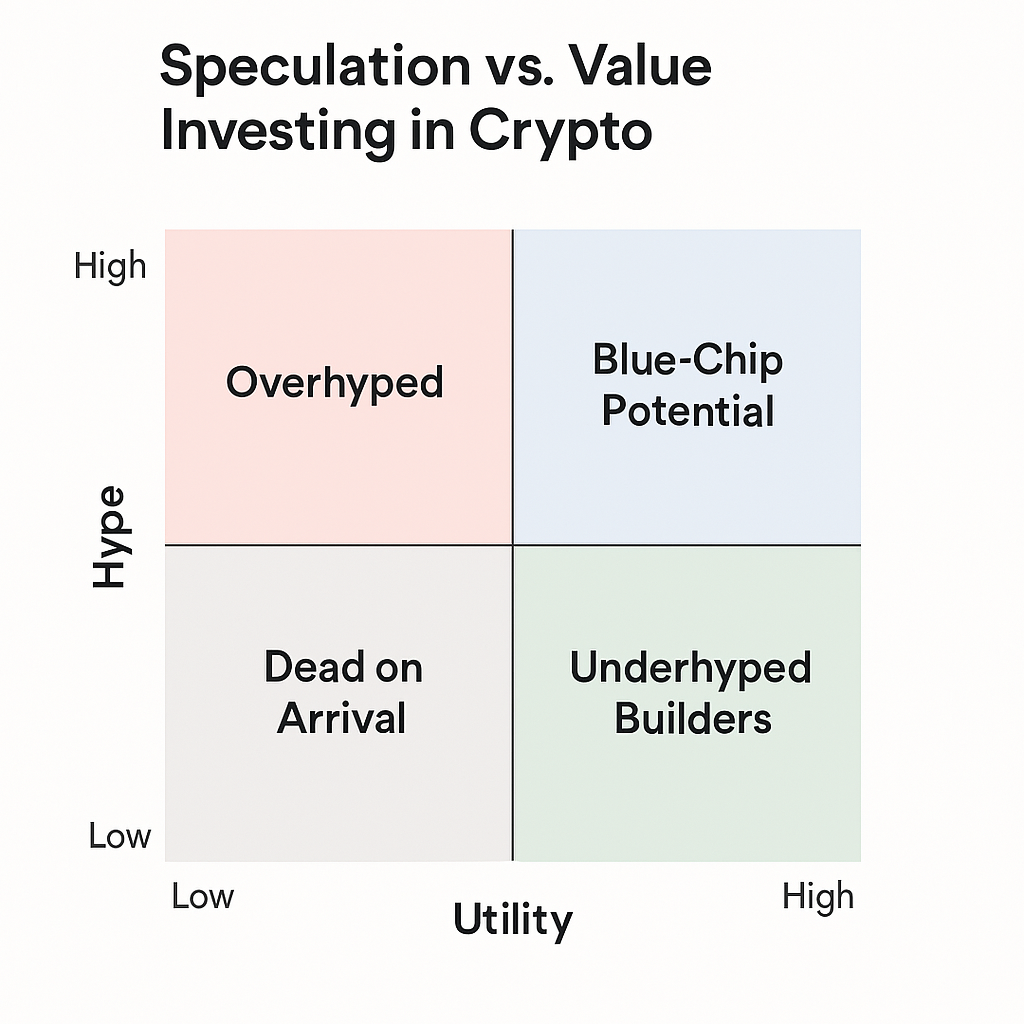

Speculation vs. Value Investing in Crypto

A quadrant chart showing speculative assets (high hype, low utility) vs. blue-chip candidates (low hype, high utility).

The Next Wave Won’t Be Obvious — Until It Is

The early internet failed to meet its sky-high expectations in the short term. But in the long run, it reshaped the world.

Crypto will walk the same road.

Most projects will vanish. But the ones that solve problems, work within legal frameworks, and scale globally will become the foundation of a new digital economy.

The winners of this era won’t be built on hype — they’ll be built on quiet conviction, strong fundamentals, and real-world utility.

That’s where Bayberry Capital is focused.

We don’t just believe in the future.

We’re investing in the infrastructure that will define it.