How the Smart Money Is Front-Running Crypto Regulation

The moves being made behind the scenes — and how you can position yourself before the floodgates open.

The Calm Before the Storm

On the surface, the crypto market feels eerily quiet.

The narratives have slowed. Volatility has compressed. Retail attention has drifted elsewhere.

It almost feels like nothing is happening.

But behind the scenes — the smart money is moving.

Family offices, private funds, and institutional players aren’t waiting for regulations to become official.

They already know how the game will be played.

And they’re positioning themselves now, quietly, before the headlines arrive.

Because by the time the public sees the rules, it will be too late.

The winners will already be bought.

The opportunities will already be gated.

And the early positioning will command premium pricing.

The fortune is made before the rules are written.

The Real Impact of Regulation

Most retail investors still think regulation is a threat — something that could “crush” crypto.

The truth is different.

Regulation isn’t about killing crypto.

It’s about clarifying the lanes — and opening the floodgates for institutional capital to come in safely.

- Pension funds

- Insurance companies

- Sovereign wealth funds

- Major banks

All of these massive pools of capital are legally restricted from touching ambiguous, unregulated assets.

Once the framework is in place, the demand for compliant, scalable digital assets will surge — almost overnight.

But not all assets will qualify.

There will be a greenlist. And everything else will fade into irrelevance.

The smart money understands this.

That’s why they’re accumulating now — not just to survive regulation, but to thrive under it.

The Tactics Smart Money Is Using Now

While the headlines focus on ETF approvals and meme coins, the smart money is laying foundations for a regulated future.

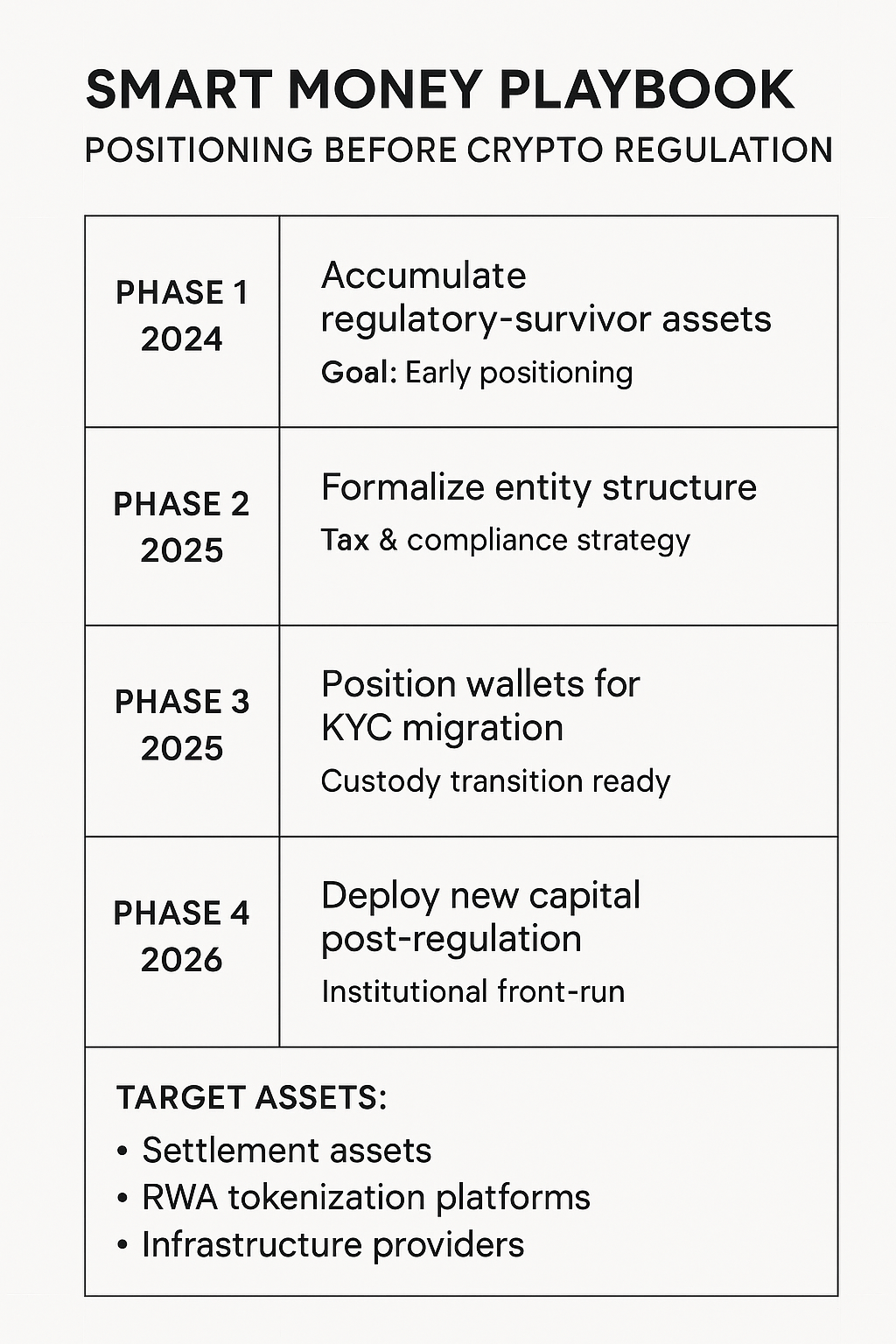

Accumulate Regulatory-Survivor Assets

Assets tied to real-world financial infrastructure, scalable utility, and institutional alignment.

Formalize Entity Structure

Trusts, LLCs, or offshore structures being set up for long-term custody, tax, and compliance benefits.

Prepare Wallets for KYC Migration

Funds are organizing holdings now in a way that can be cleanly migrated into regulated custodians if needed.

Deploy Capital Post-Regulation

Early positions allow them to sell access to institutions later — not scramble to buy it.

“The best time to position is when nobody else sees the need to.”

What Assets They’re Targeting

No one’s betting on hype anymore.

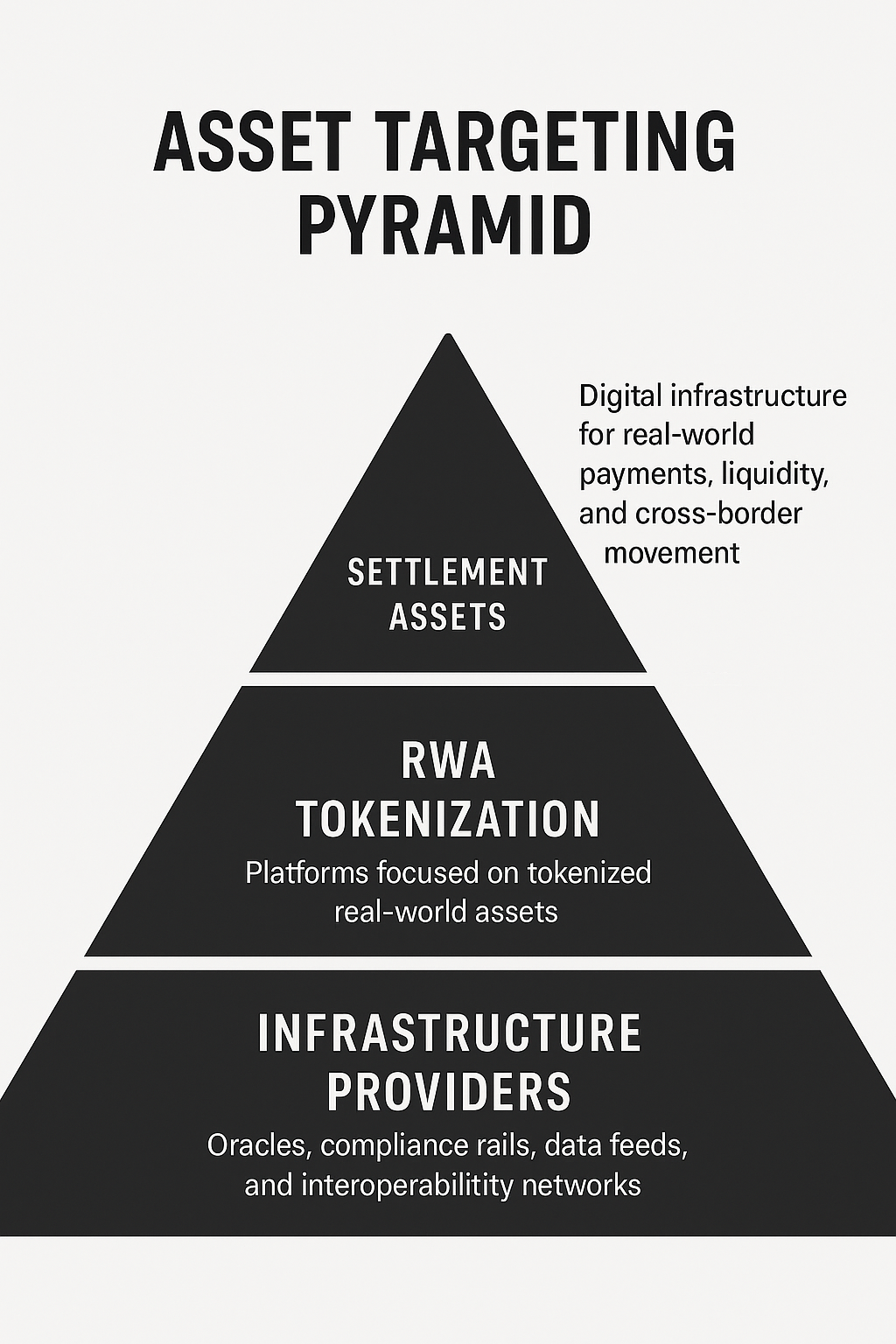

Smart capital is consolidating into three primary sectors:

Top Survivability Sectors:

- Settlement Assets - Digital infrastructure for real-world payments, liquidity, and cross-border movement.

- RWA Tokenization Platforms - Assets tied to tokenized real-world assets — like treasuries, real estate, commodities, or bonds.

- Infrastructure Providers - Oracles, compliance rails, data feeds, and interoperability networks.

These aren’t speculative plays — they’re the plumbing of the next financial system.

Why the Window Is Closing

Retail assumes they’ll have time.

That regulation will move slowly.

That they’ll be able to “wait and see.”

But they won’t.

- Major custodians are preparing internally now.

- Regulators are being lobbied quietly by the firms that already know where this is going.

- Accumulation is happening quietly while the crowd is distracted.

When the public headlines finally hit, it won’t be the start of opportunity — it will be the end of early access.

“Early” positioning earns premium access.

“Late” positioning pays the premium.”

Actionable Playbook: How to Front-Run Regulation Yourself

You don’t need a massive fund to position like the insiders — you just need clarity and patience.

1. Shift from Speculation to Infrastructure

Focus on digital assets powering payment rails, tokenized value, and financial interconnectivity.

2. Simplify and Concentrate

Don’t scatter across 50 coins. Focus tightly on high-survivability, high-utility sectors.

3. Prepare for Compliance

Clean up your holdings. Use wallets and accounts that can migrate smoothly into regulated custody environments if needed.

4. Extend Your Time Horizon

Think in 2–5 year positioning windows. Don’t expect the market to reward clarity immediately — it rewards conviction over time.

“Insiders don’t wait for the headlines.

They move quietly, precisely, and early.”

Final Words

This isn’t a speculative phase.

It’s a structural one.

And those who treat it like positioning — not gambling — will have the greatest edge when the system flips.