RLUSD Is Not Competing With XRP

It Is Unlocking It

For years, the crypto market has framed stablecoins and native assets as competitors.

That framing is wrong.

Stablecoins are not designed to replace native liquidity assets. They are designed to prepare capital to move. And when capital is prepared correctly, the infrastructure beneath it becomes exponentially more valuable.

RLUSD is not a threat to XRP.

It is a catalyst.

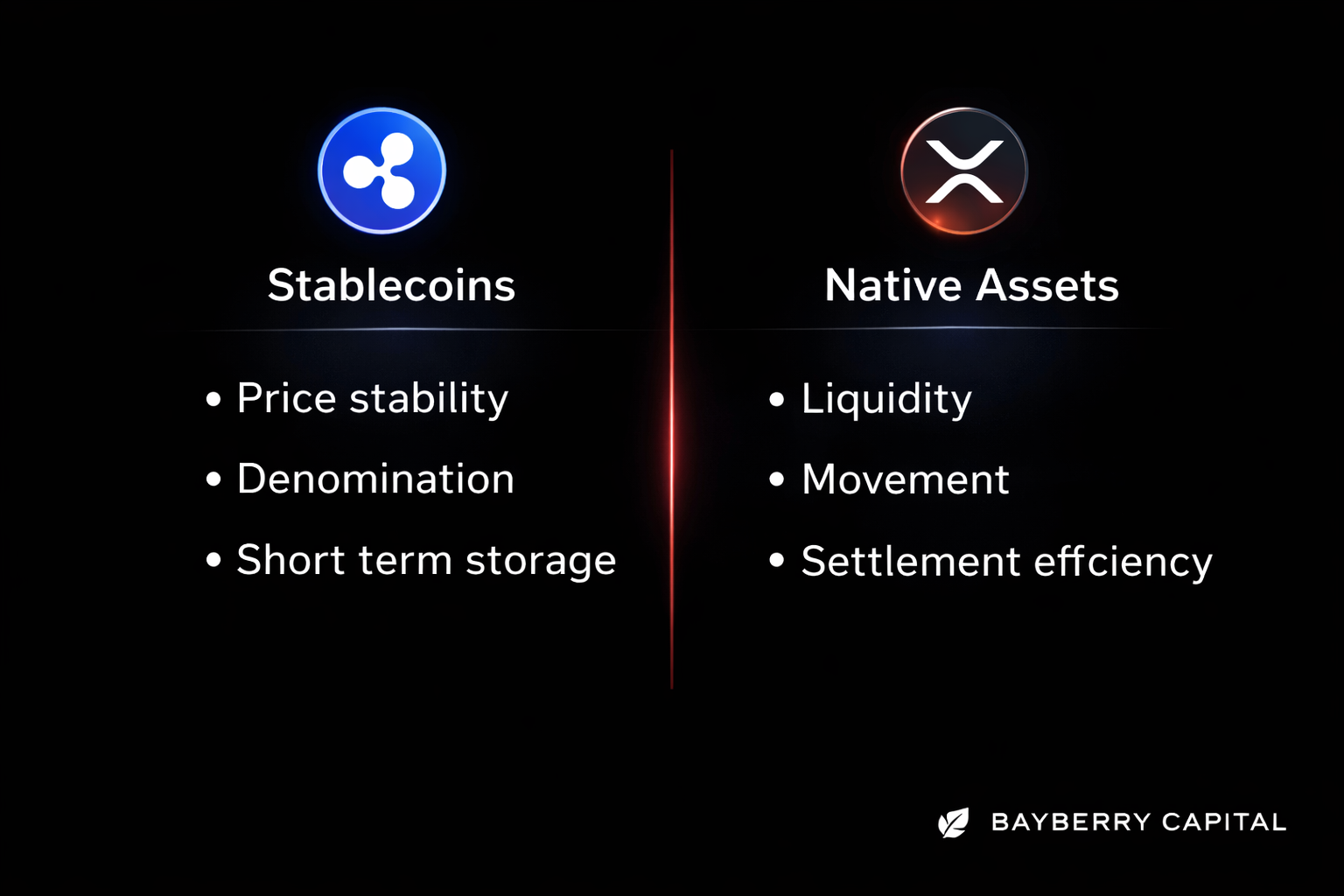

To understand why, you have to separate denomination from movement. This distinction is still widely misunderstood.

The Core Misunderstanding: What Stablecoins Actually Do

Stablecoins solve one problem extremely well.

They provide a predictable unit of account.

Institutions do not begin financial flows with volatility. They begin with certainty.

Treasurers, payment providers, and enterprises require dollar stability, regulatory clarity, and balance sheet compatibility.

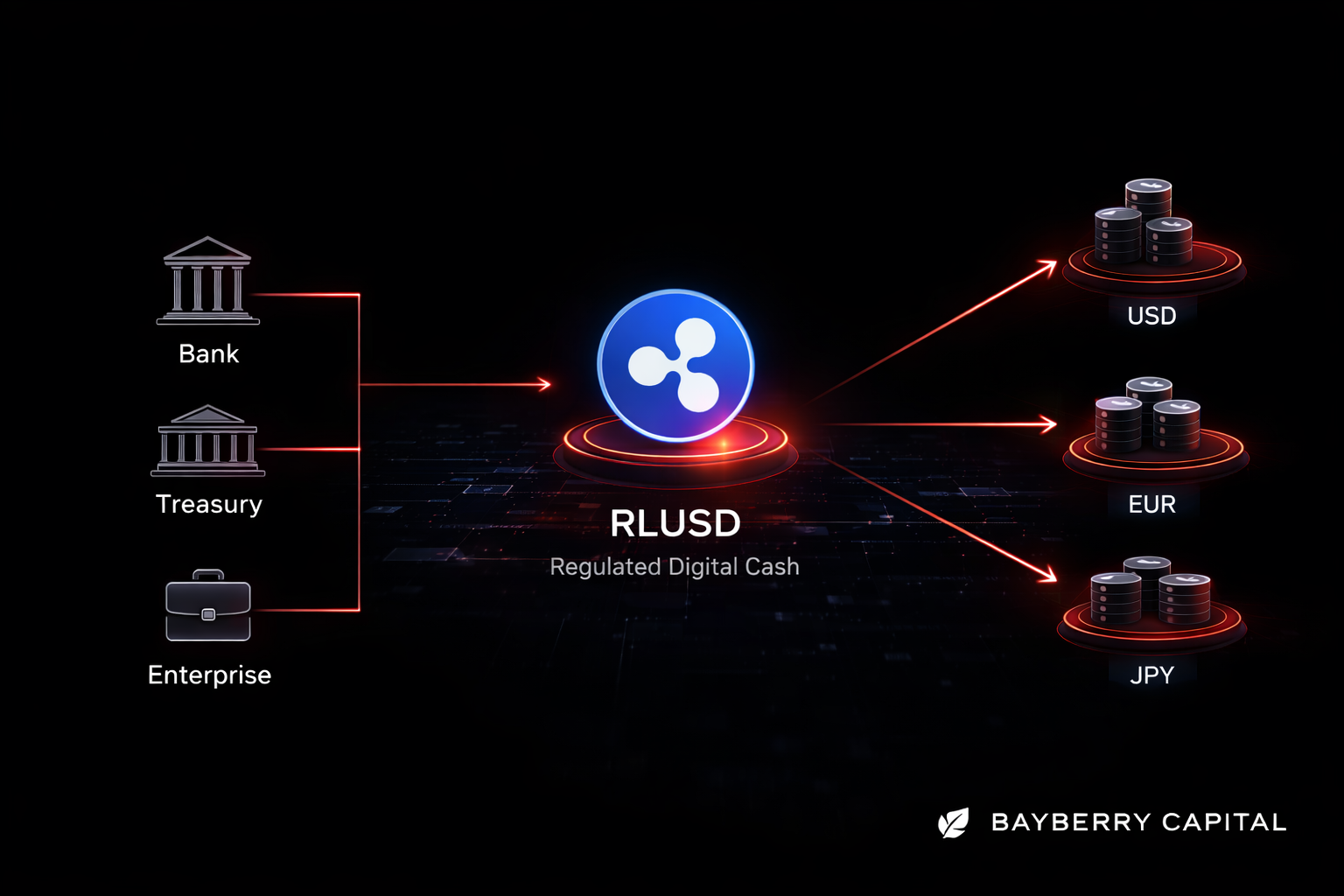

RLUSD is designed to meet those requirements.

But certainty alone does not move value efficiently across borders, systems, and time zones. That function belongs to native liquidity assets.

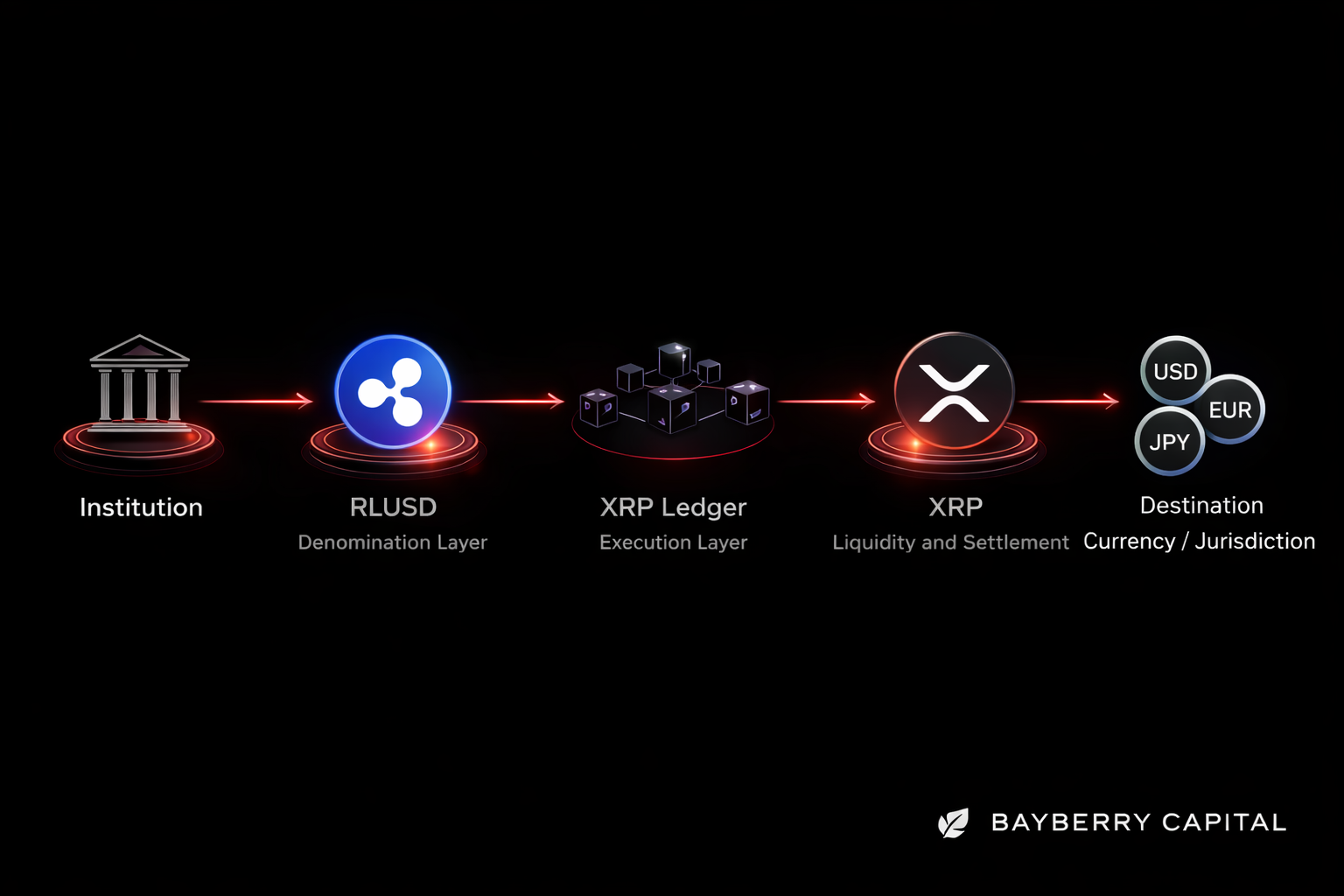

The Separation That Changes Everything

Think in systems, not tokens.

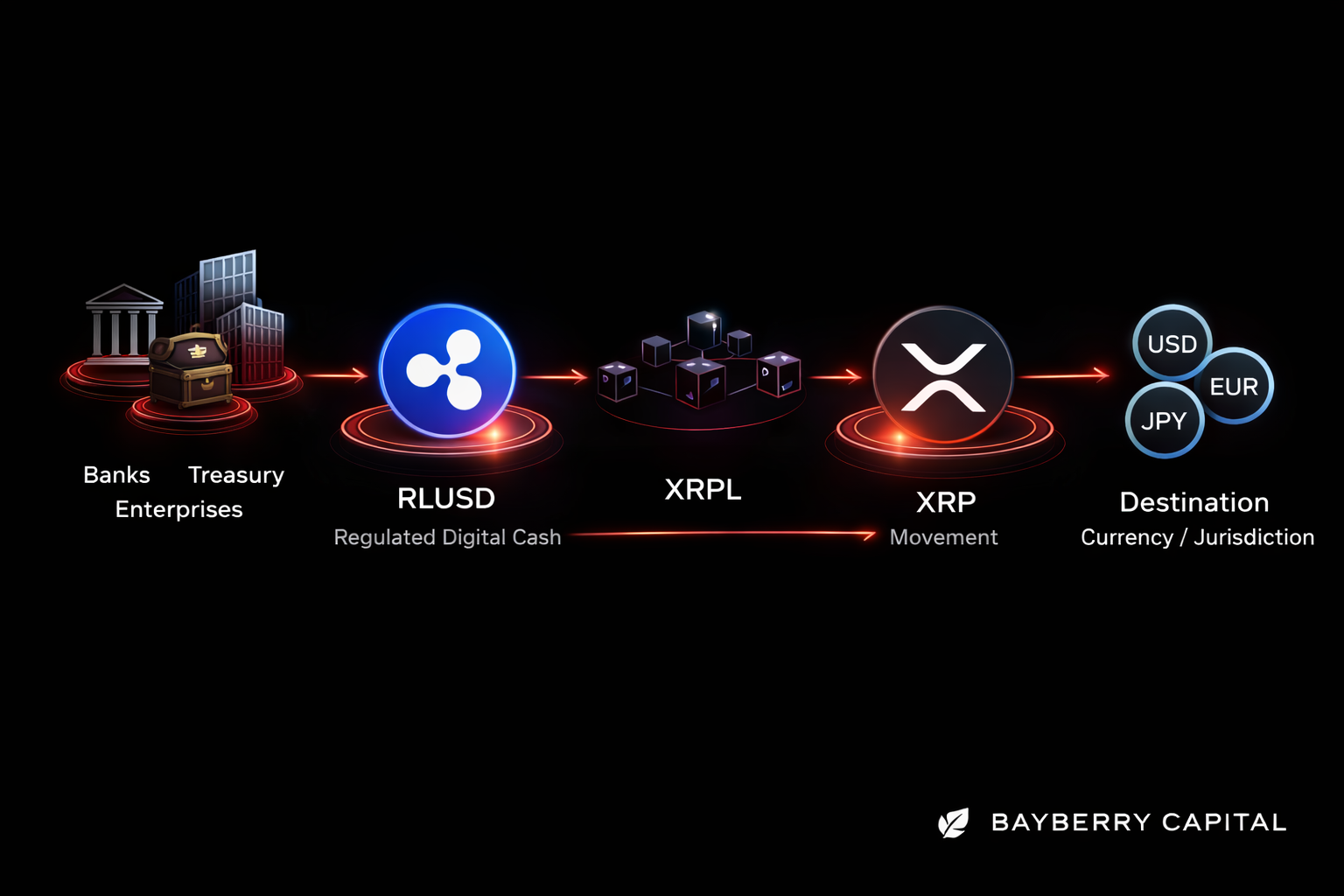

RLUSD handles denomination.

XRP handles movement.

RLUSD behaves like digital cash.

XRP behaves like a liquidity engine.

One is meant to sit briefly.

The other is meant to move relentlessly.

This separation mirrors how real financial infrastructure already works. The difference is speed, cost, and global reach.

Why RLUSD Expands XRP Use Cases

When RLUSD exists natively within the XRP Ledger ecosystem, several effects emerge naturally.

Cleaner On and Off Ramps

Capital enters the system in a form institutions already trust. This reduces friction before XRP is even involved.

More Efficient Liquidity Routing

Once value must move across currencies or jurisdictions, XRP becomes the optimal bridge. Speed and cost dominate decision making.

Reduced Dependence on Correspondent Banking

Pre funded accounts become less necessary. Settlement risk drops. Capital efficiency rises.

This is not theoretical. It is the direct result of separating storage from movement.

Why the Vampire Narrative Misses the Point

Some market participants describe RLUSD as a vampire, suggesting it will drain liquidity from other stablecoins.

That framing is shallow.

RLUSD does not need to attack anything. If enterprises adopt it for payments and treasury operations, liquidity will naturally concentrate where execution is faster and cheaper.

Liquidity follows reliability, cost efficiency, and settlement finality.

That flow benefits the rails underneath.

In this case, those rails include XRP.

Stablecoins Do Not Eliminate Native Assets

They Reveal Which Ones Actually Work

In weak ecosystems, stablecoins replace native assets because there is no reason to use them.

In strong ecosystems, stablecoins amplify native assets because they expose which networks can move value most efficiently.

If XRP were slow, expensive, or unreliable, RLUSD adoption would bypass it entirely.

Instead, RLUSD creates more scenarios where XRP is the rational choice.

Infrastructure Compounds Quietly

Crypto does not win through narratives.

It wins through plumbing.

Payments infrastructure is invisible until it becomes indispensable. By the time the market notices, the architecture is already embedded.

RLUSD is infrastructure.

XRP is infrastructure.

Infrastructure does not announce itself loudly.

It simply gets used repeatedly until the system depends on it.

Final Thought

The future of digital finance is not token maximalism.

It is role clarity.

When denomination and movement are handled by assets designed for those exact functions, scale becomes inevitable.

RLUSD does not replace XRP.

It gives XRP room to do what it was built to do.