The Discipline of Accumulation

There’s no shortage of noise in digital assets. Every week, a new narrative, a new meme, or a new pump-and-dump cycle captures attention. Most investors get caught up in this endless carousel, chasing volatility instead of mastering discipline.

But the real alpha has never been in chasing. It has always been in the quiet, consistent act of accumulation.

Accumulation vs. Gambling

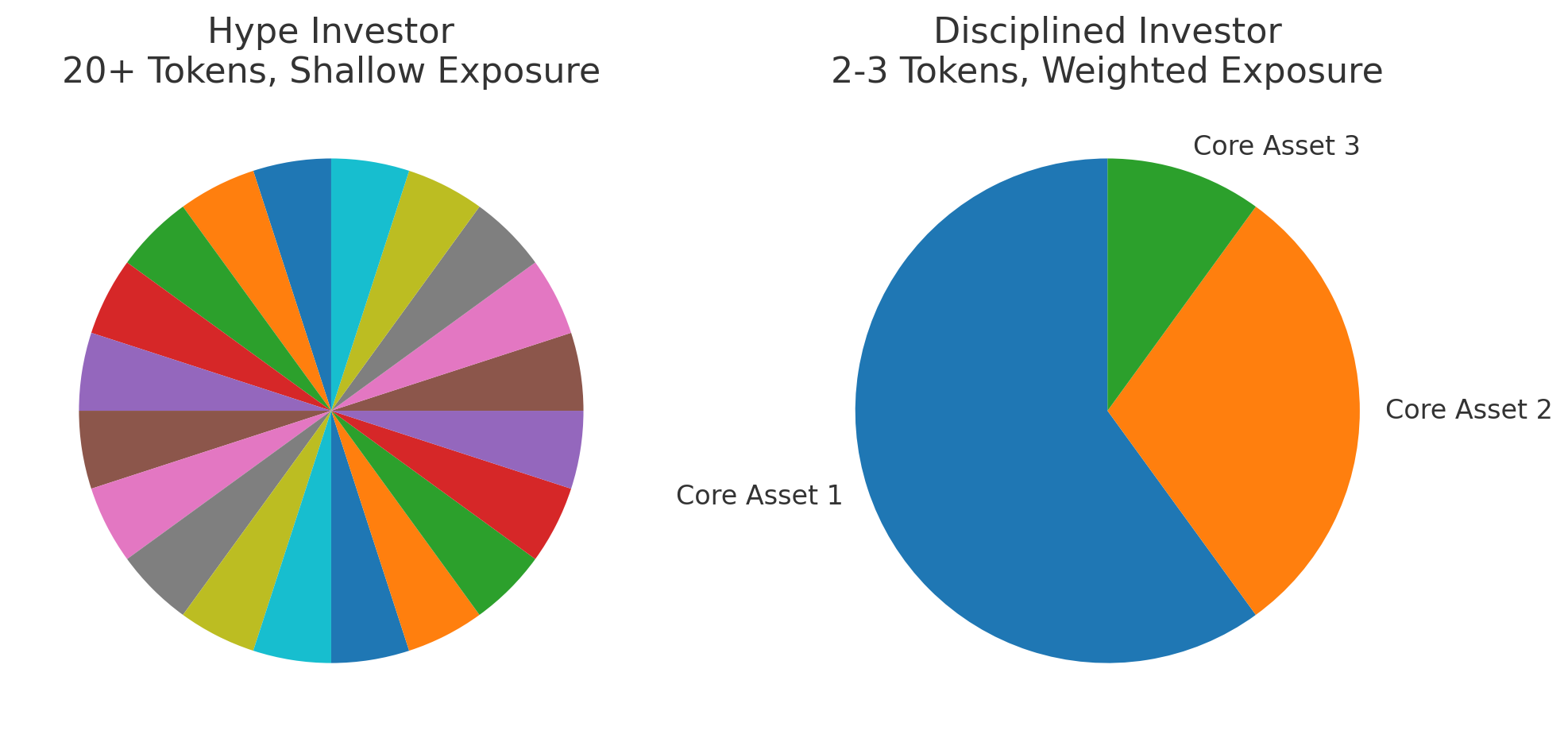

A scattered portfolio is not a strategy — it’s a gamble.

Most market participants own a little of everything: ten, twenty, sometimes even fifty tokens with no real conviction in any of them. This isn’t investing; it’s speculation disguised as diversification.

The disciplined investor moves differently.

They identify one, two, or at most three assets with real utility, strong fundamentals, and a future they believe in.

Then they build depth. Not surface-level exposure. Not a quick flip. Weight.

The Philosophy of Weight

Owning an asset is one thing. Owning enough of it to matter is another.

The power of conviction comes not from merely holding, but from holding with depth.

Wealth accrues to those who are willing to concentrate, endure volatility, and let compounding play out. When the thesis matures, the investor with a strong position doesn’t just survive the cycle — they define it.

Compounding the Quiet Way

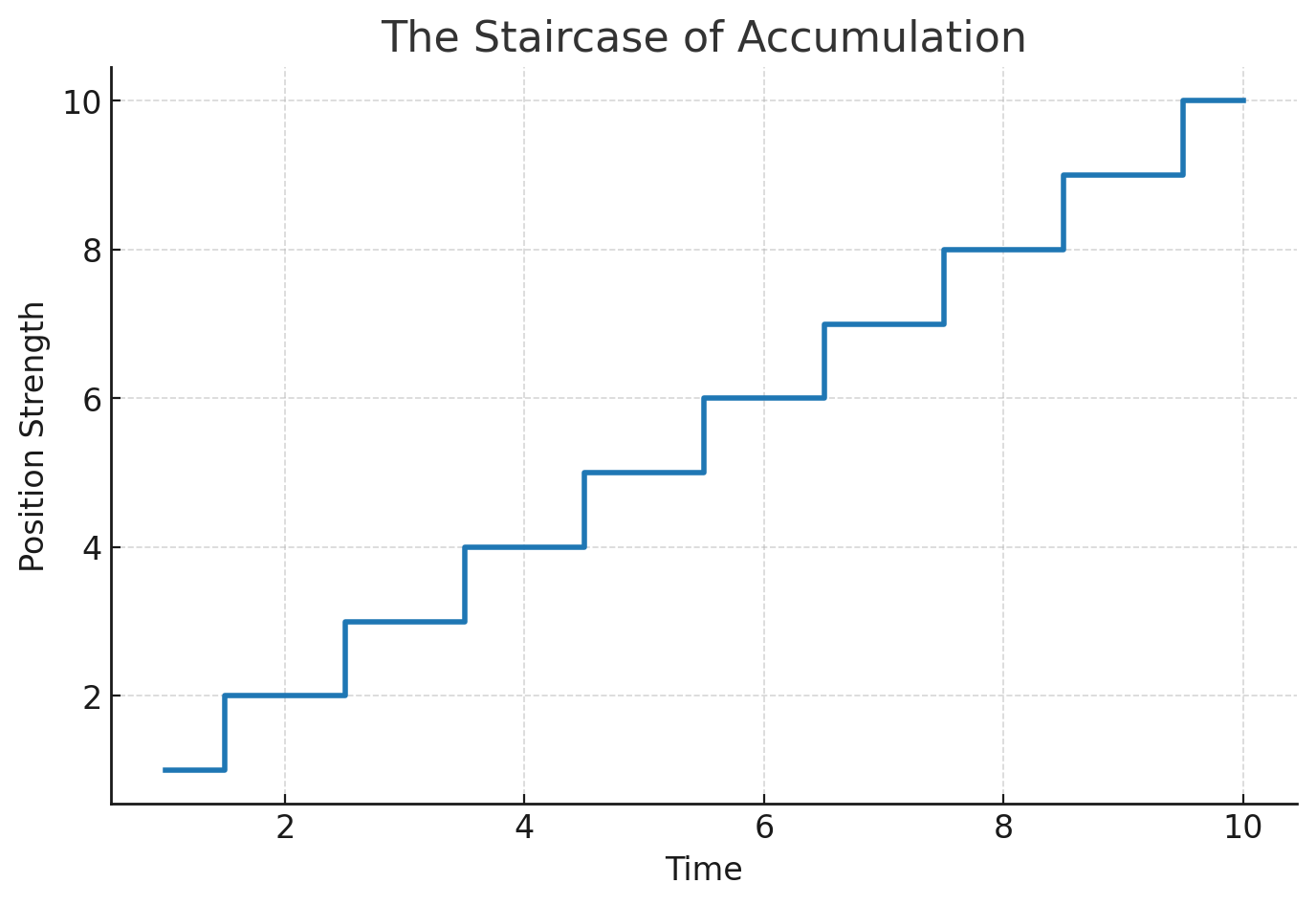

Accumulation is not exciting in the moment. It is repetitive, unglamorous, and often invisible.

- Buying the same asset week after week.

- Showing up in both bull runs and drawdowns.

- Executing a plan regardless of noise.

But compounding doesn’t need to be glamorous. It only needs to be consistent.

The disciplined investor doesn’t wait for the “perfect entry.” They build relentlessly, knowing the thesis is larger than any single candle.

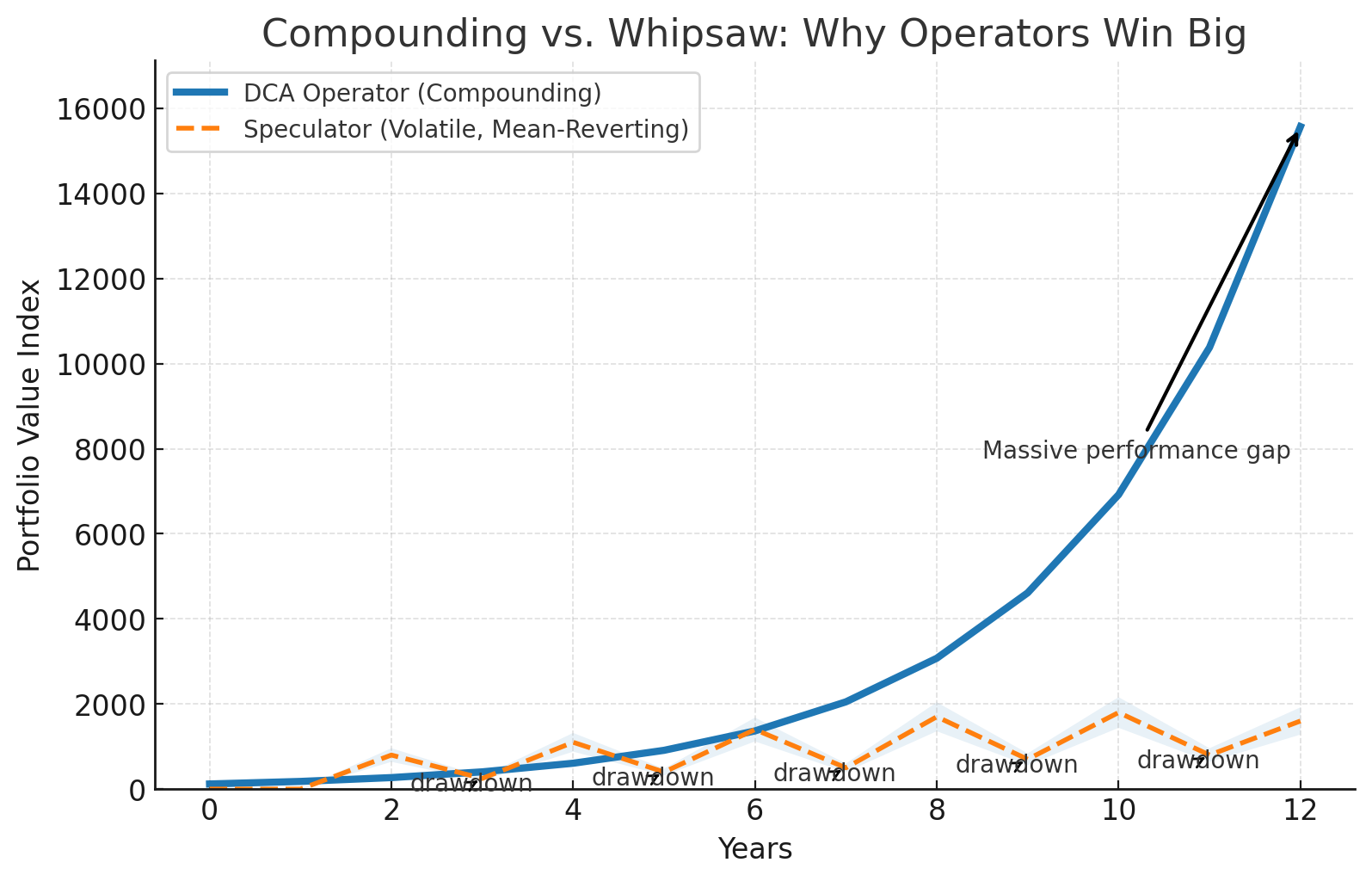

The Operator vs. the Spectator

Markets are full of spectators. They watch prices, refresh charts, chase headlines. Spectators react to the game as it unfolds.

Operators, on the other hand, are the ones running the play. They execute a plan. They don’t flinch with volatility, because their conviction is already set.

Accumulation is how operators move. Quietly. Consistently. Without distraction.

Discipline as the Ultimate Alpha

Market cycles are ruthless. They punish impatience, reward conviction, and magnify the habits of investors. Those who chase the latest narrative are left behind. Those who endure with discipline compound wealth.

The truth is simple:

- It is not about being first to every trade.

- It is not about outsmarting every market twist.

- It is about positioning yourself so strongly that when your thesis matures, the outcome is inevitable.

Discipline is the edge. Accumulation is the alpha.

Bayberry Capital was built on this principle — not as a spectator in digital assets, but as an operator. And the path forward remains the same: conviction, weight, and the quiet discipline of accumulation.