The Sixteen Trillion Dollar Flood. What BCG’s Tokenization Forecast Means for the Future of Digital Finance.

There are moments in finance when a single projection changes the direction of an entire industry. Boston Consulting Group’s estimate that up to sixteen trillion dollars worth of global assets will be tokenized by 2030 is one of those moments.

This is one of the most respected consulting firms in the world analyzing capital markets, interviewing institutions, and assessing global infrastructure readiness. Their conclusion is simple.

The world is preparing to move real financial value onto blockchain rails.

For most investors this still sounds abstract. For Bayberry Capital this is the center of our thesis.

Tokenization is not just a trend. It is the transformation of financial plumbing itself. It is the modernization of settlement, collateral, liquidity, issuance, and global money movement.

The sixteen trillion dollar projection is not a wild guess. It is a signal that a new financial system is already forming beneath the surface.

Infrastructure is finally catching up to demand.

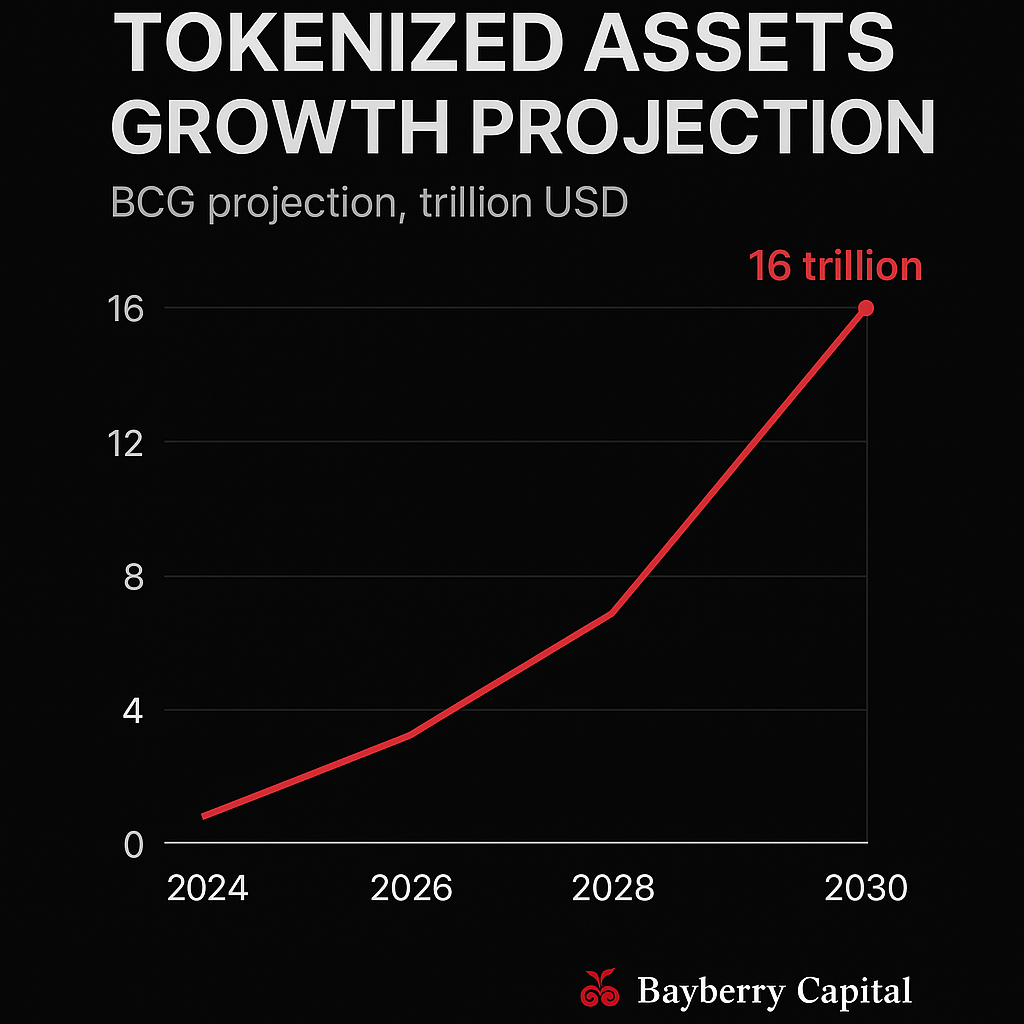

BCG’s Forecast at a Glance

BCG’s projection shows an explosive acceleration in tokenized value through the end of the decade. The curve is unmistakable.

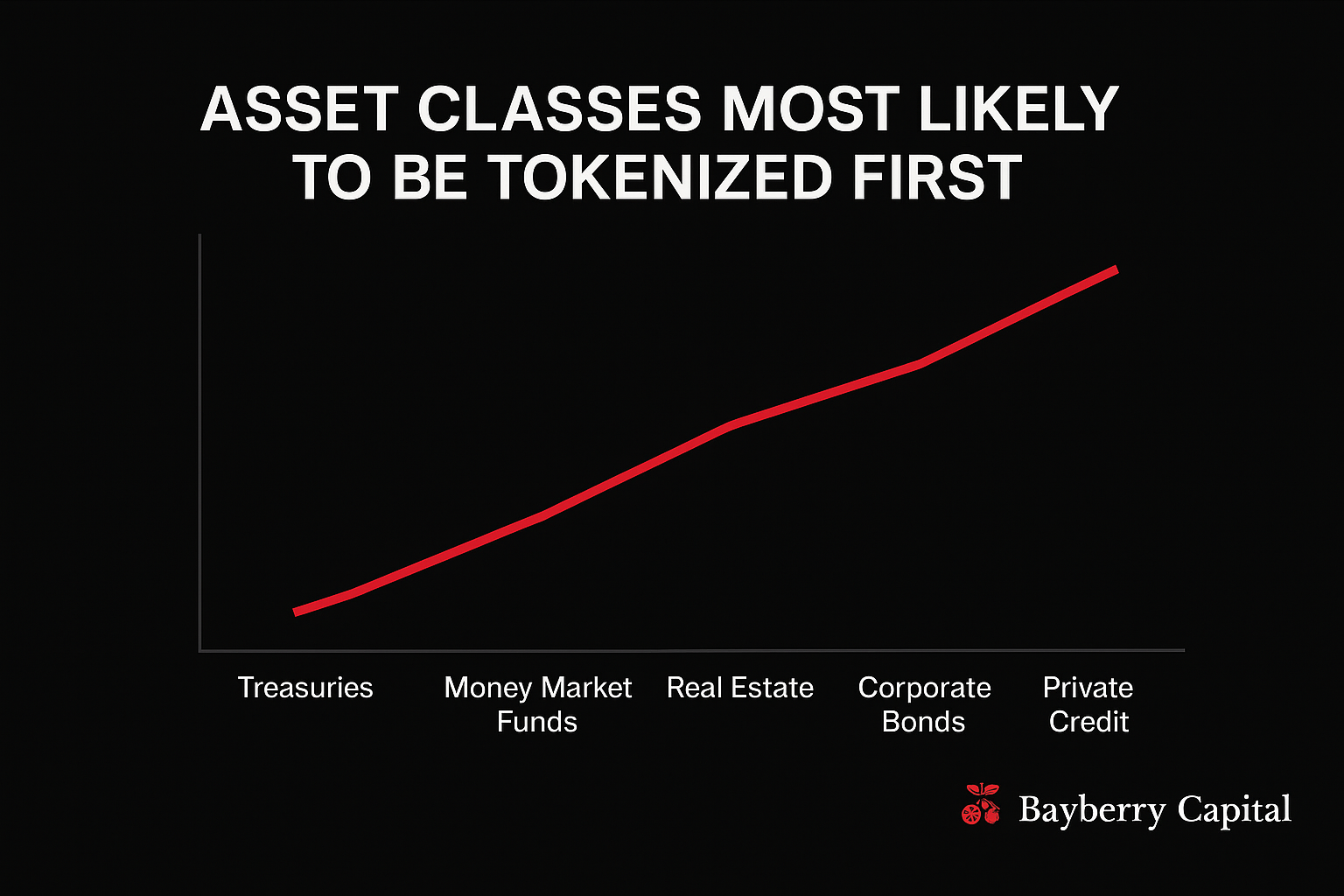

The Categories That Move First

Not all asset classes tokenize at the same pace. Some move earlier because they are simpler, more liquid, or already live inside regulated frameworks.

Treasuries, money market funds, and real estate lead the wave. Credit products follow.

This matches what the largest institutions are already experimenting with today.

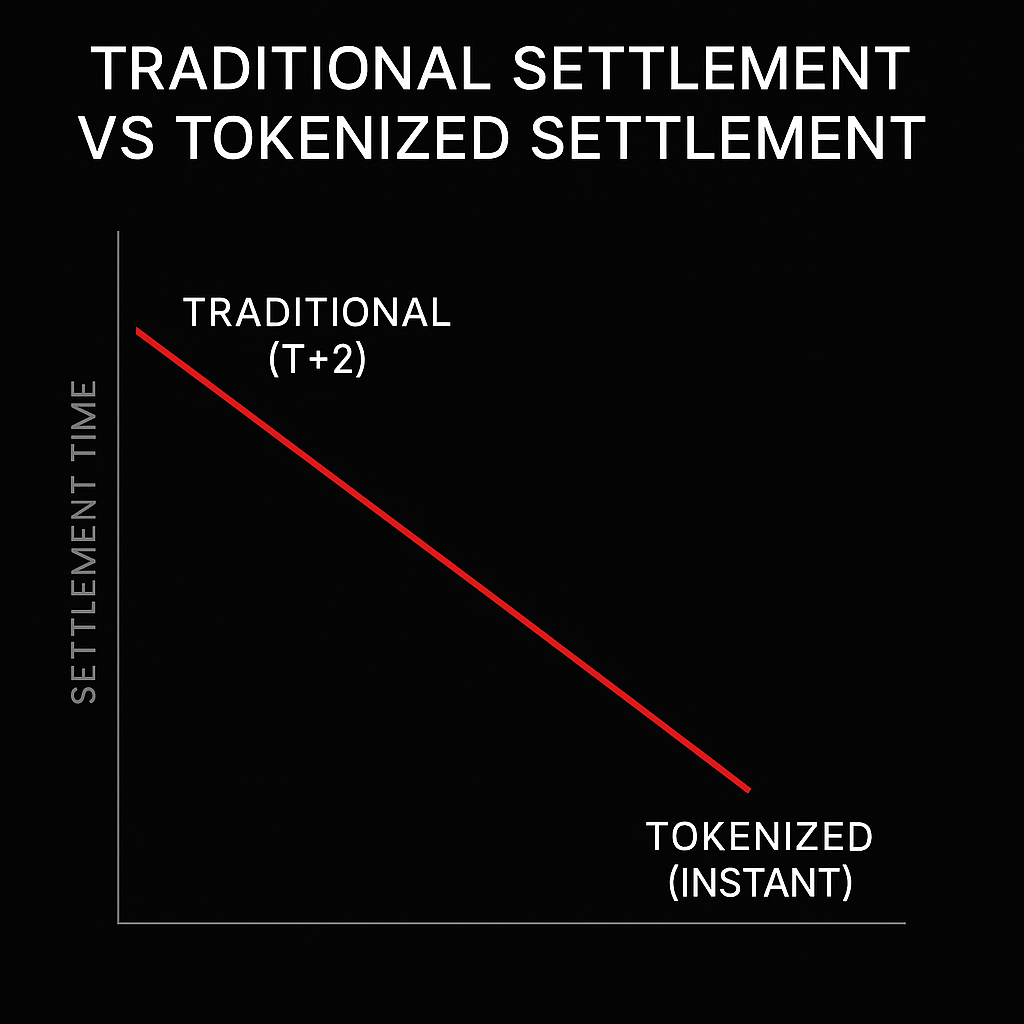

The Settlement Problem Becomes Unavoidable

Traditional settlement infrastructure cannot handle the demands of a global, twenty four hour digital economy.

It is slow. It is fragmented. It is expensive.

Tokenization fixes that through instant finality.

A shift from T plus two to instant finality is not an upgrade. It is a reconstruction of financial plumbing.

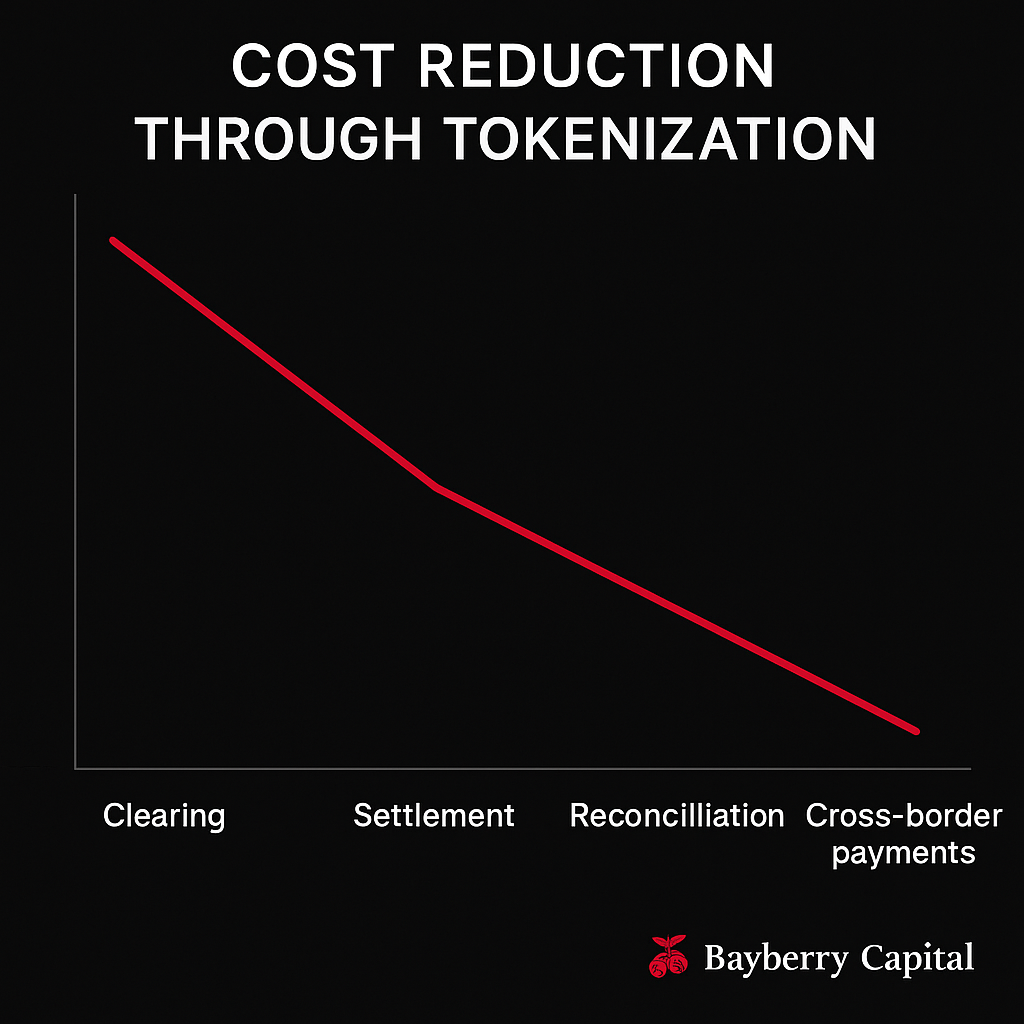

The Cost Structure Collapses in Favor of On Chain Rails

Every institution cares about cost. Clearing, settlement, reconciliation, and cross border transfers eat massive amounts of money every single year. Tokenization compresses these costs dramatically.

When the cost profile of an entire industry changes, capital follows.

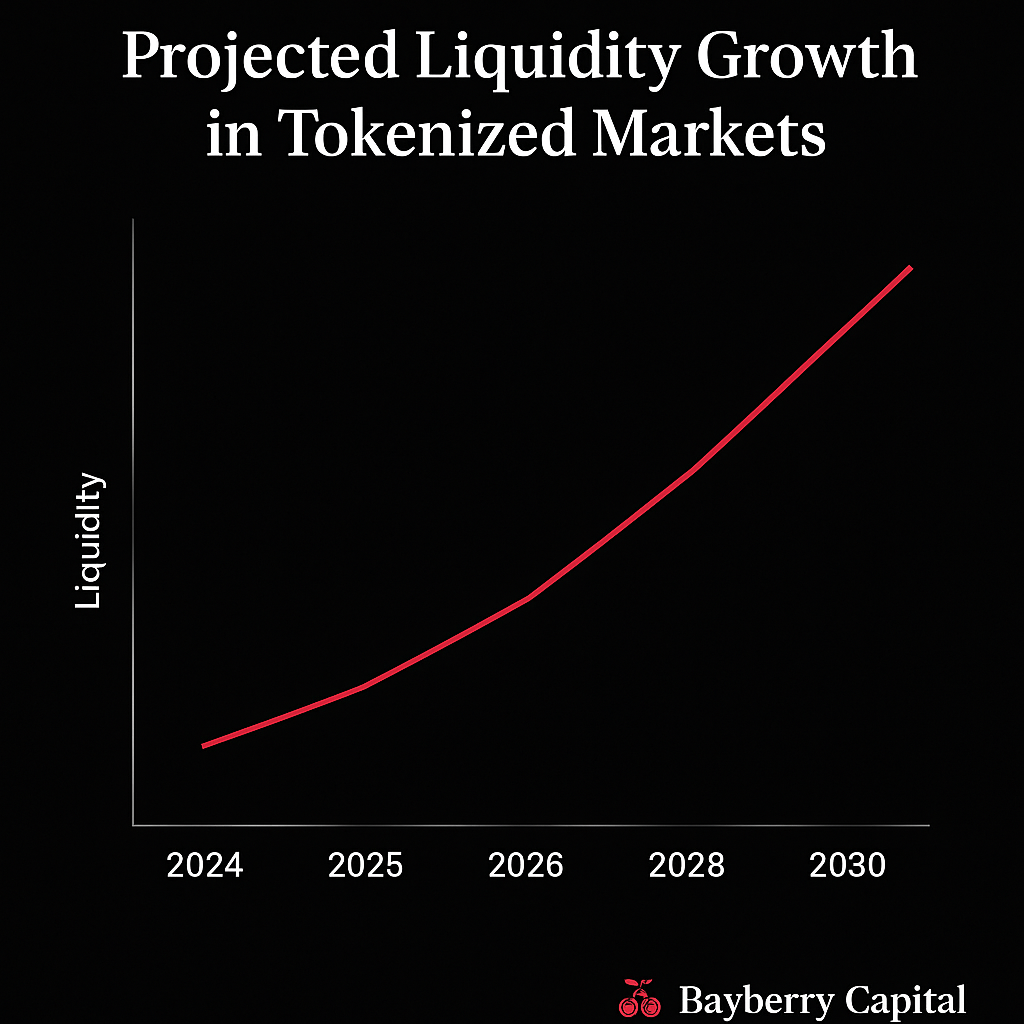

Liquidity Deepens as Tokenization Scales

Liquidity is the lifeblood of global markets. Tokenized assets unlock deeper and more fluid liquidity by reducing fragmentation and enabling constant market access.

The chart speaks for itself. Liquidity compounds once assets share a common programmable settlement layer.

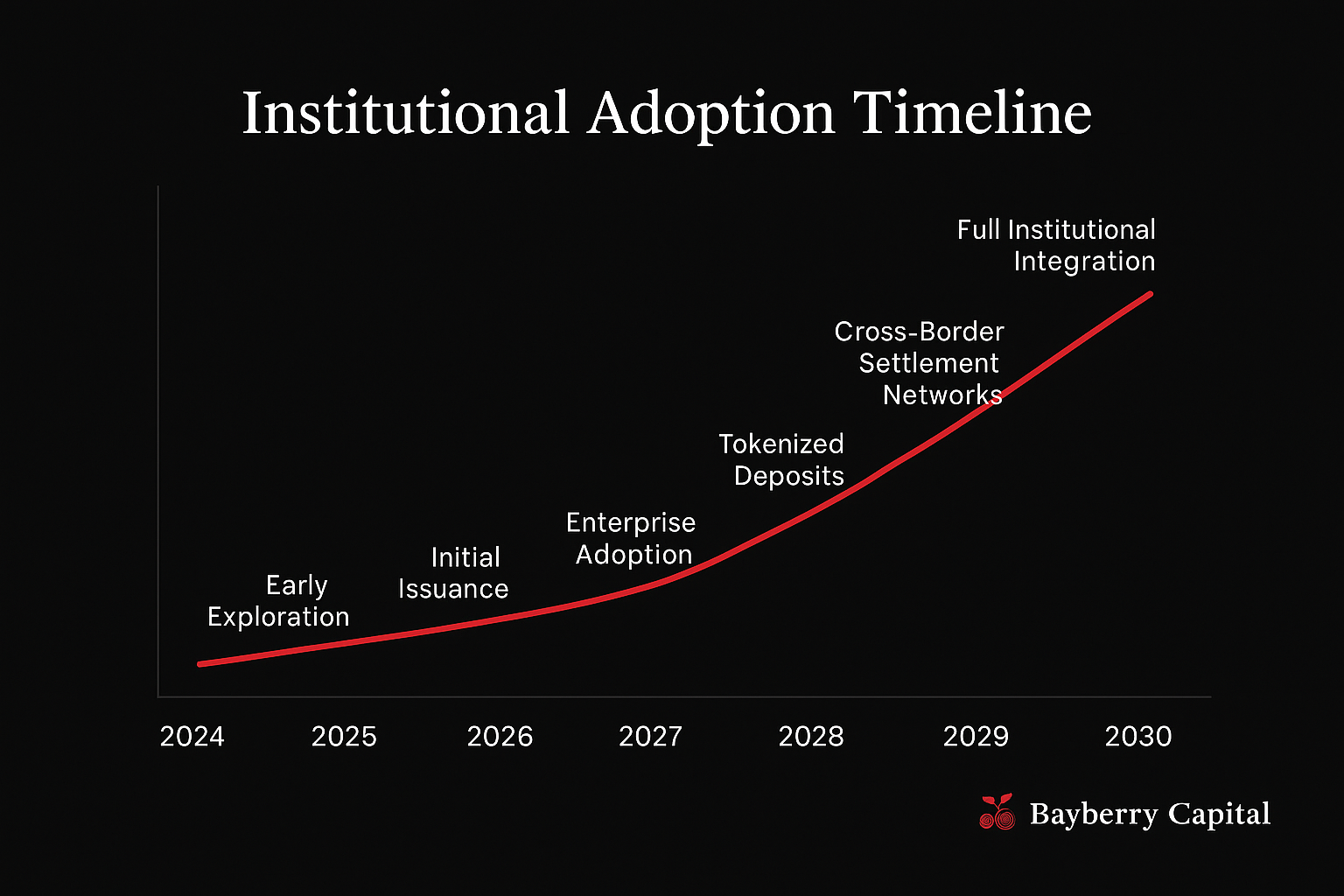

Institutional Adoption Is No Longer A Question of If

The last decade was dominated by speculation and narrative. The coming decade is dominated by institutional adoption. The architecture is being laid right now.

Exploration becomes issuance. Issuance becomes adoption. Adoption becomes integration.

The timeline is already unfolding.

What This Means for Bayberry Capital

BCG’s research confirms what we have been preparing for.

Tokenization is not hype.

It is the next architecture of global finance.

The value will not flow to the loudest narratives.

It will flow to the networks that actually move value.

On settlement layers, not speculation.

On infrastructure, not entertainment.

This is where the multi trillion dollar opportunity lives.

And this is where we intend to operate.