The Tokenized World Thesis

The Age of Tokenization Has Already Begun

This isn’t a theory. It’s already happening.

Trillions of dollars in traditional financial assets—money markets, U.S. Treasuries, real estate, private debt—are being reissued on-chain. Not as a bet. As a migration.

BlackRock didn’t tokenize its first fund on Ethereum for publicity. Citi didn’t build its private blockchain to explore a trend. These are strategic moves toward an unavoidable future: a digitized global financial system running on trustless rails.

Tokenization is not about crypto hype. It’s about financial infrastructure.

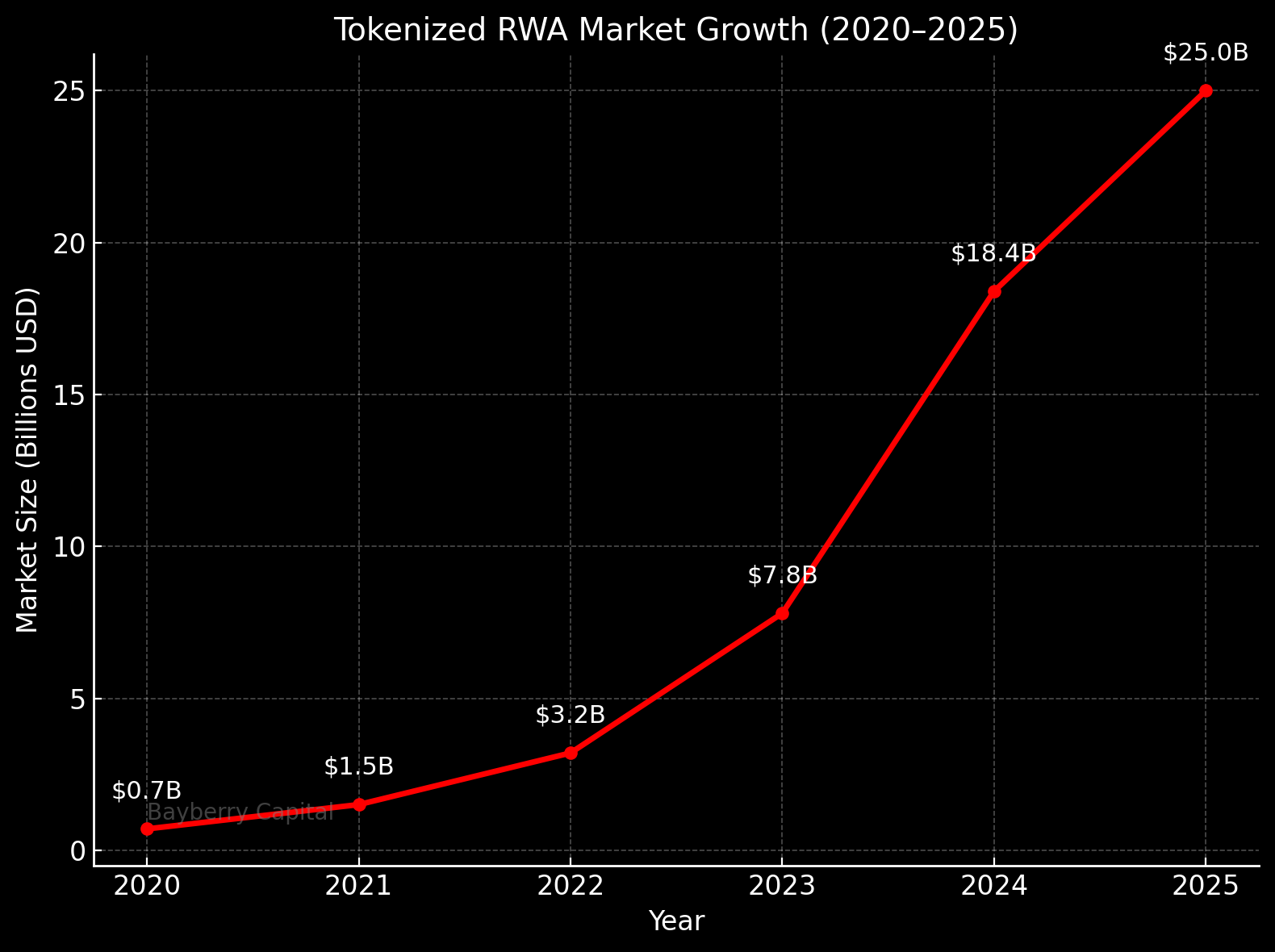

According to 21.co and RWA.xyz:

- Tokenized RWAs have already crossed $25 billion in value

- On-chain adoption has surged +145% in under two years

- Treasury-backed protocols like Ondo, Backed, and Matrixdock are growing faster than many Layer 1s

Infrastructure Is Where the Value Accrues

In every era of disruption, infrastructure captures the value.

Not the gimmicks. Not the noise. The rails.

The internet rewarded cloud providers, databases, and payment layers—not the flashiest sites. The same pattern is unfolding in crypto. The winners will be the protocols that settle capital, not the ones chasing attention.

Tokenization will not reward speculation.

It will reward settlement.

At Bayberry Capital, we’re focused on:

- XRP — as a cross-border liquidity and settlement asset

- XLM — for its low-friction FX and remittance infrastructure

- Institutional stablecoins — where real-world capital enters the rails

Stablecoins and the Liquidity On-Ramp

The tokenized world will run on stability.

Stablecoins already settle more volume than Mastercard annually. But that’s just the beginning. As institutions tokenize treasuries, cash, and credit, stablecoins become the bridge.

Stablecoins are the liquidity layer of the next financial stack.

USDC and USDT paved the way—but RLUSD, Ripple’s new stablecoin, signals the next phase: enterprise-grade stable liquidity, built for tokenized capital markets.

- Fully backed by cash and T-Bills

- Launching on XRP Ledger and Ethereum

- Designed for regulated flows and real-world usage

The play isn’t just the stablecoin.

It’s the rail it moves on.

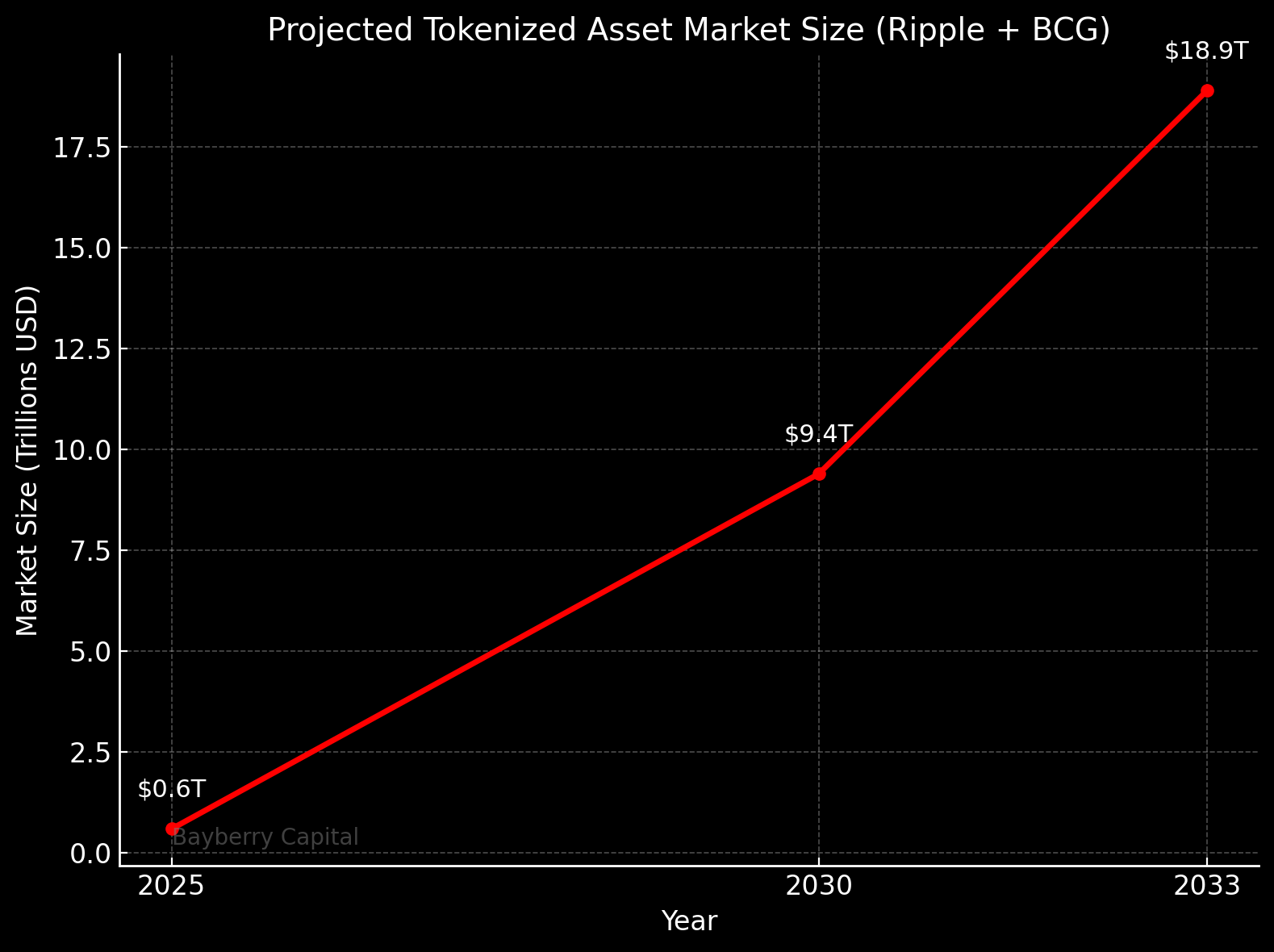

The $18.9 Trillion Tipping Point

In April 2025, Ripple and Boston Consulting Group published a clear projection:

Tokenized assets will grow from

$0.6 trillion in 2025

to $9.4 trillion by 2030,

and $18.9 trillion by 2033

That’s a 53% CAGR over the next decade.

They broke it into three phases:

- Low-Risk Pilots – Tokenized treasuries, MMFs, stablecoins

- Institutional Expansion – Real estate, private credit, structured products

- Market Transformation – Full-scale tokenization of capital markets

Each phase requires faster rails, compliant issuance, and trusted settlement layers. That’s not a narrative. That’s a roadmap.

Bayberry Capital’s Thesis Execution

We don’t predict the future. We position for it.

We don’t chase narratives. We build positions in the rails that will matter when the capital arrives.

Bayberry Capital is structured around:

- XRP – cross-border infrastructure

- XLM – global payments & FX rails

- RLUSD – long-term stablecoin bridge

- Minimalist diversification – only into protocols aligned with real-world usage

We don’t need 50 coins.

We need exposure to the assets that settle capital at scale.

This is how wealth is built—through asymmetric positioning in the infrastructure no one’s paying attention to… until it becomes inevitable.

The rails are being built.

The capital is coming.

We intend to own both.