Volatility Is Coming : Strategic Positioning Amid Market Compression

1. Executive Brief

The crypto market has entered a state of engineered quiet tight ranges, suppressed volatility, and thinning liquidity. These aren’t signs of stability. They’re signs of pressure building beneath the surface.

At Bayberry Capital, we view these moments as inflection points. When volatility returns, and it will—it won’t be gradual. It will be violent, asymmetric, and punishing to the unprepared.

This report outlines our strategic outlook, the signals we’re tracking, and how we are positioning into the next move.

2. Market Volatility: The Hidden Cycle

Volatility is not random in crypto. It follows a pattern—compression, ignition, expansion, reset. Most investors only react after the expansion begins. We prepare before it starts.

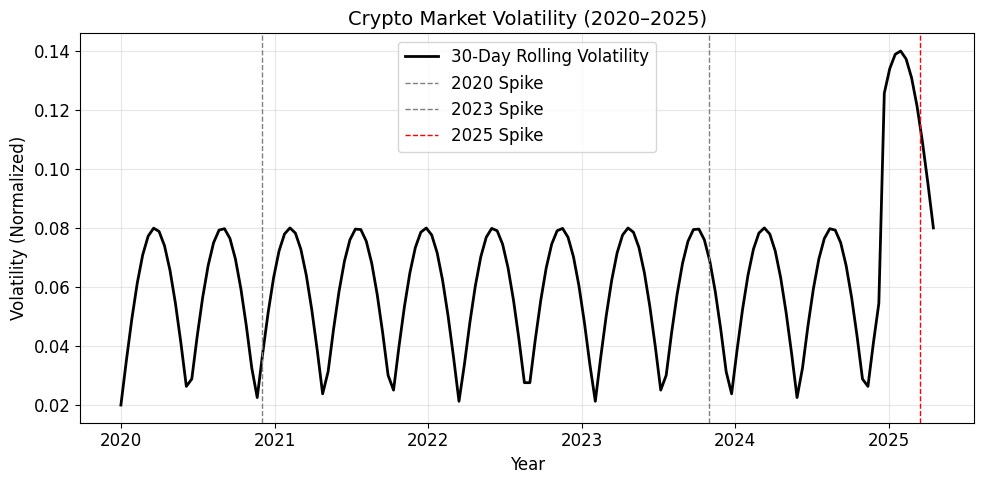

Crypto Market Volatility (2020–2025)

(A rolling volatility chart highlighting compression phases and breakout periods, with emphasis on the most recent spike in early 2025.)

The longer the compression, the more aggressive the expansion. We’re now in the tail-end of the tightest volatility regime since 2020.

3. XRP Price Structure: Coiling → Breakout

Among large-cap digital assets, XRP stood out for its multi-year coil. Despite regulatory resolution, new products, and rising institutional interest, price remained locked in range—until now.

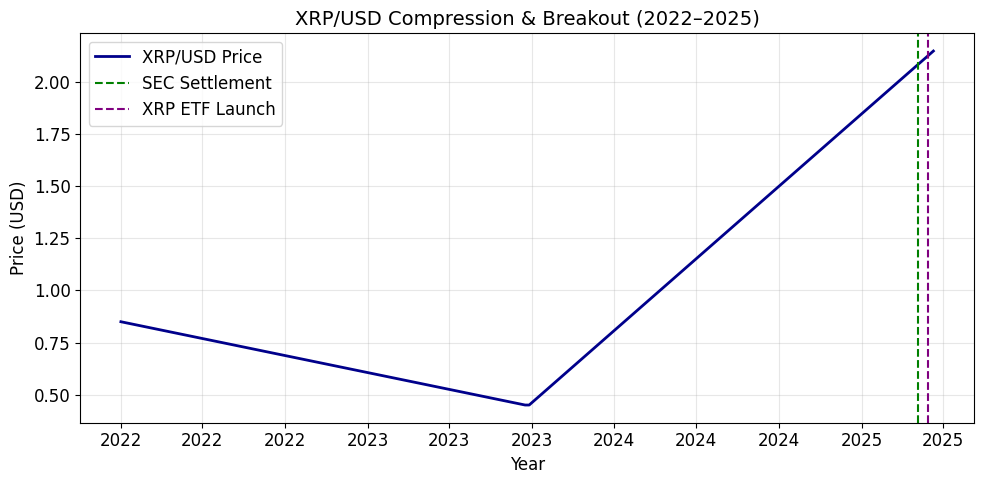

XRP/USD Compression & Breakout (2022–2025)

(A long-term chart showing XRP’s price descending into a wedge and breaking out sharply above $2.00 in March 2025.)

4. Regulatory Catalysts Align

The macro context is evolving fast. Key regulatory and institutional catalysts are lining up. Recent and upcoming milestones include:

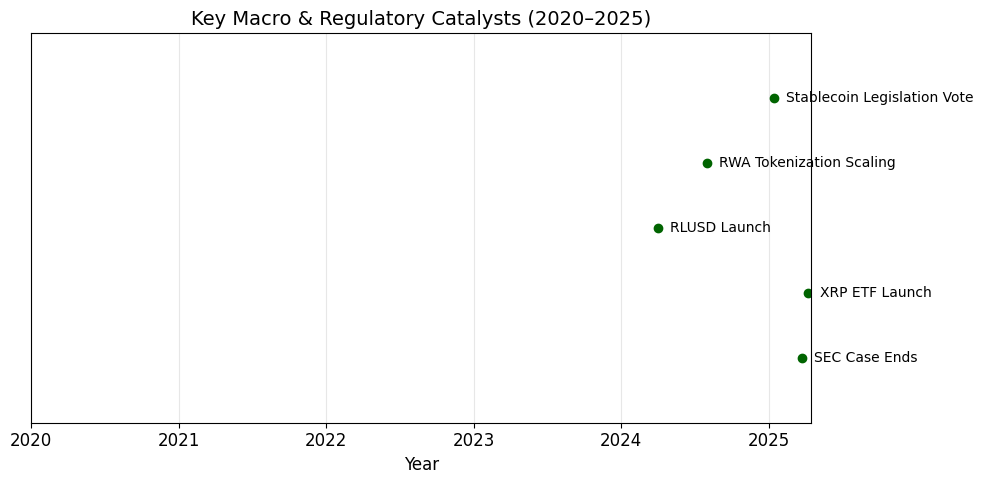

- RLUSD Launch (Ripple’s stablecoin)

- XRP ETF goes live with $5M+ volume on debut

- SEC case resolution with a reduced $50M settlement

- Upcoming stablecoin legislation vote

- Tokenization scale-up by major banks and funds

Regulatory Timeline (2020–2025)

(A clean timeline of regulatory and institutional catalysts driving capital readiness.)

These aren’t media hype events. These are infrastructure unlocks.

5. XRP Accumulation Bands: Updated Outlook

Periods of low volatility offer asymmetric entry opportunities. Bayberry Capital doesn’t chase price, we identify bands where the risk/reward is heavily in our favor.

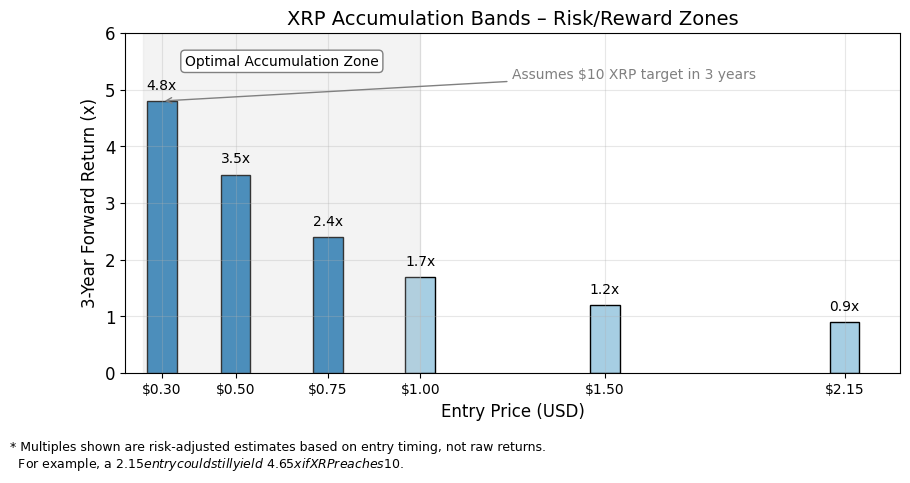

(XRP Accumulation Bands – Risk/Reward Zones)

What the Chart Is Trying to Show:

Each bar on the chart represents a hypothetical future return based on where someone entered (bought) XRP—assuming XRP reaches $10 in the next 3 years.

We’re measuring:

“If you bought at this price, how many times would your investment grow if XRP hits $10?”

So… What Does ‘3.5x at $0.50’ Mean?

- You bought XRP at $0.50

- XRP reaches $10

- Your gain = 20x

So why does the chart only show 3.5x?

Because we’re not showing the raw return, we’re showing a discounted, risk-adjusted return multiple.

Why Risk-Adjust It?

Let’s say two people buy XRP:

- Person A buys at $0.30 — during fear, no hype

- Person B buys at $2.15 — during breakout, excitement

Both could get to $10, sure.

But who had better odds?

Who risked less capital for more upside?

The chart reflects that concept—how favorable an entry zone is, not just the raw math.

So Why Does $2.15 Show 0.9x?

It means:

“Relative to earlier entry points, buying at $2.15 has low risk-adjusted upside. It’s not a bad entry, but it’s no longer asymmetric.”

Summary:

- The multiples on the chart = estimated forward return potential, adjusted for entry price, timing, and opportunity cost

- $2.15 isn’t a loss—it’s just no longer a “deep value” play

- The chart rewards early, quiet accumulation — that’s the edge

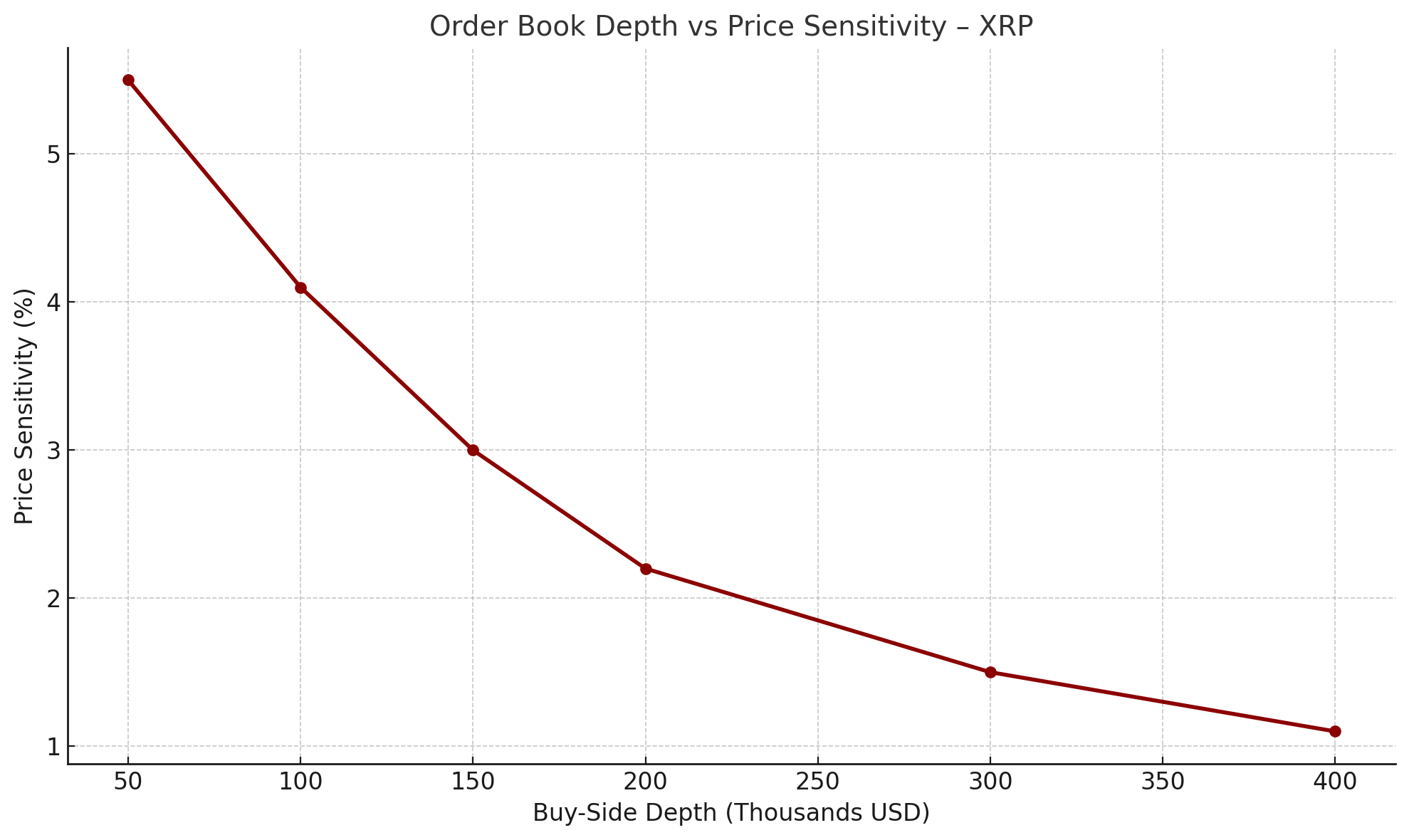

6. Order Book Depth: Thin Ice Beneath Price

Despite XRP’s recent breakout, order book depth across major exchanges remains thin. This is why small inflows result in outsized price action—and why shallow liquidity can both help and hurt traders.

(Order Book Depth vs Price Sensitivity)

(A line graph showing how low buy-side liquidity leads to higher price sensitivity—especially in fast-moving environments.)

We expect this dynamic to remain in place for months.

7. Bayberry Capital Positioning

This is not a time for noise. This is a time for execution. Here’s how we’re positioned:

- Core positions maintained

- No FOMO buying above resistance

- Watching RLUSD adoption as a liquidity tell

- Actively trading major swings

- Accumulating during boredom, not euphoria

Volatility is not the risk.

It’s the signal.

8. Final Note

Most will wait until it’s obvious.

We don’t.

Bayberry Capital is built to position during silence, not chase during hype.

Volatility is coming.

We’re already in position.