XRP Market Update- Korean Flow, Whale Distribution, and Futures Frenzy

Bayberry Capital | July 11, 2025

XRP made headlines this week with a decisive surge, recapturing attention across the digital asset landscape. But this wasn’t a meme pump or random bounce—it was backed by coordinated exchange flows, leveraged positioning, and deep pockets operating behind the scenes.

Let’s break down what really happened, where the volume originated, and what it signals for the road ahead.

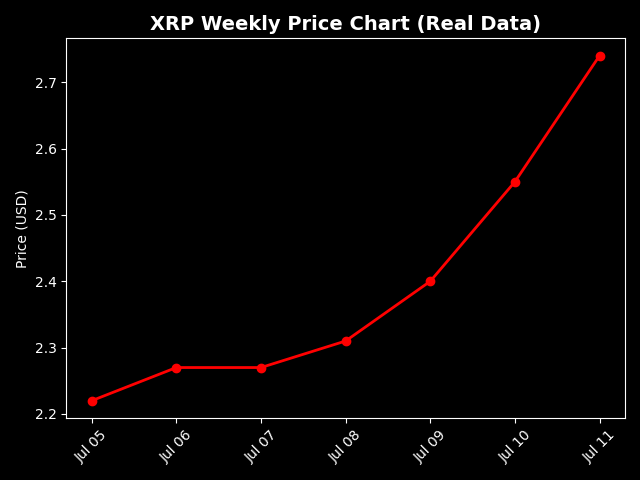

Weekly Price Action

- XRP Weekly Change: +14% to +27%

- 7-Day Range: ~$2.20 → ~$2.85

- Current Price: ~$2.75 (as of July 11)

- Intraday High: $2.91

- Intraday Low: $2.52

While some headlines reported a +30% move, the actual data shows a strong but slightly lower gain across most trading venues. Regardless, this was one of XRP’s sharpest weekly breakouts in months—and the volume backed it up.

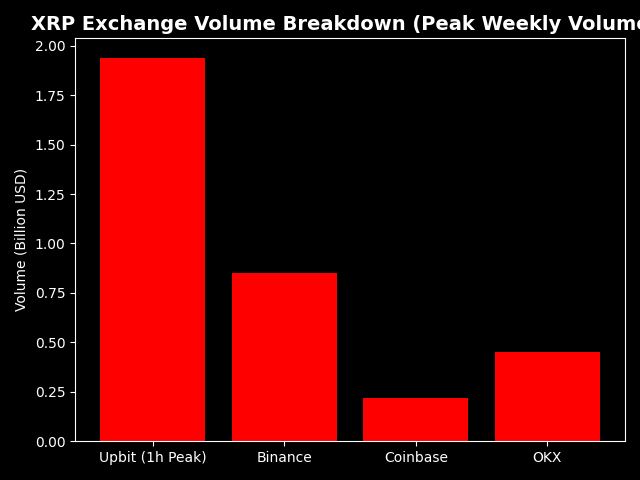

Volume Snapshot

- Global 24-Hour Volume: ~$15.5 billion

- Upbit (South Korea): ~$269 million (daily spot)

- Binance: ~$226 million

- Coinbase: Minimal impact

- Upbit One-Hour Spike: Estimated ~$160M to $1.9B during peak

At first glance, it appeared that Korean retail traders were driving this move. But in truth, the scale and timing of activity suggest institutional capital routed through Korean exchanges—not fragmented individual buyers.

Institutional Activity Disguised as Retail

While Korean exchanges like Upbit don’t support futures or leverage, they do serve as major fiat on-ramps for local institutions, crypto-native firms, and high-net-worth OTC flows. During periods of volatility, these entities often:

- Route capital through personal or shell accounts

- Exploit regulatory arbitrage and premium spreads

- Appear “retail” on the surface due to the structure of Korean markets

In other words:What looked like a retail-driven pump was almost certainly powered by Korean institutions operating through domestic exchanges.

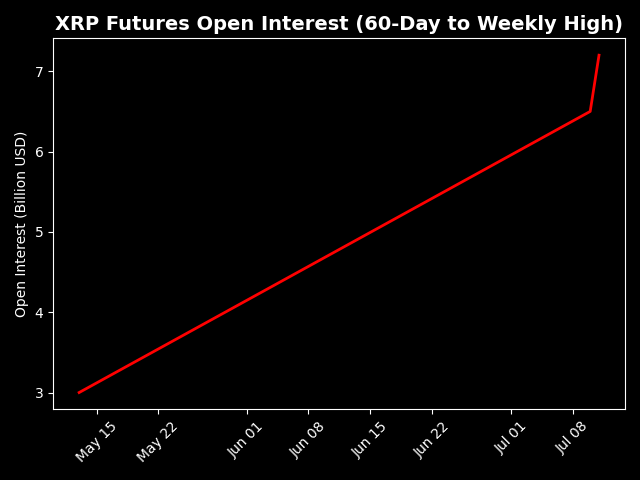

Derivatives & Futures Activity

- Open Interest (Futures): ~$5.0B to $7.2B across major exchanges

- Funding Rates: Positive across the board, occasionally annualizing >10%

- Long/Short Ratio (Binance XRP/USDT): ~2:1 in favor of longs

- 6-Month OI Highs: Confirming speculative enthusiasm

XRP perpetual futures spiked across Binance, Bybit, OKX, and Hyperliquid—revealing a sharp increase in leveraged bullish bets. This supported spot demand and further fueled upside momentum.

Whale Behavior — Profit-Taking Into Strength

While Korean-based flows bought aggressively, on-chain data showed whale wallets reducing their positions into the rally. This divergence is telling:

- Whales distributed as price surged

- Institutional and speculative buyers absorbed supply

- Retail (global) joined late, chasing momentum on Binance and other platforms

This kind of behavior is classic:

Large players exit while attention rises and liquidity floods in.

Summary Table

|

Metric |

Value / Insight |

|

Weekly Price Move |

+14% to +27% |

|

Dominant Exchange |

Upbit (Korea) with ~$1.9B peak hourly flow |

|

Institutional Flows |

Likely routed through Korean “retail†accounts |

|

Whale Behavior |

Net sellers during the breakout |

|

Futures Activity |

Multi-month highs in OI, highly leveraged |

|

Market Risk |

Elevated due to leverage and profit-taking |

Bayberry Capital’s Take

This wasn’t a meme-driven pump. It was a calculated rotation of capital—likely from Korean institutional players—pushing volume through Upbit and triggering a cascade of momentum buying across futures markets.

XRP remains a high-beta asset in moments like these. For disciplined capital allocators, the goal is not to chase, but to understand the underlying flows and position accordingly when liquidity dislocates from value.

We continue to monitor XRP as a core infrastructure asset, with a long-term view focused on utility, settlement rails, and real-world integration. Short-term volatility provides insight—not distraction.