XRP: Redefining Liquidity

- Executive Summary

Over the last decade, the global financial system has wrestled with the limits of pre-internet infrastructure underpinning trillions of dollars in daily cross-border value transfer. SWIFT messaging, correspondent banking, and siloed settlement rails have introduced chronic inefficiencies into global liquidity movement.

XRP, originally designed as a bridge asset for universal value transfer, is emerging as a key infrastructure layer in a future where value moves as easily as information. With an open, neutral ledger, XRP solves for liquidity fragmentation, enabling instant settlement without the need for pre-funded accounts or trust-based intermediaries.

Following years of regulatory challenges, XRP is now positioned as one of the few digital assets that can meet both market utility demands and evolving compliance frameworks — giving it a unique edge as institutions pivot toward blockchain-based rails.

This report breaks down XRP’s role in:

- Fixing broken global payment systems

- Unlocking capital trapped in Nostro/Vostro accounts

- Serving as neutral liquidity for the tokenized economy

- Competing against traditional and crypto-native alternatives

- Withstanding legal and technical scrutiny at a global scale

As digital assets shift from speculation to infrastructure, XRP remains one of the most asymmetric and misunderstood assets in the space. This is not a meme coin. This is the plumbing for a new financial world.

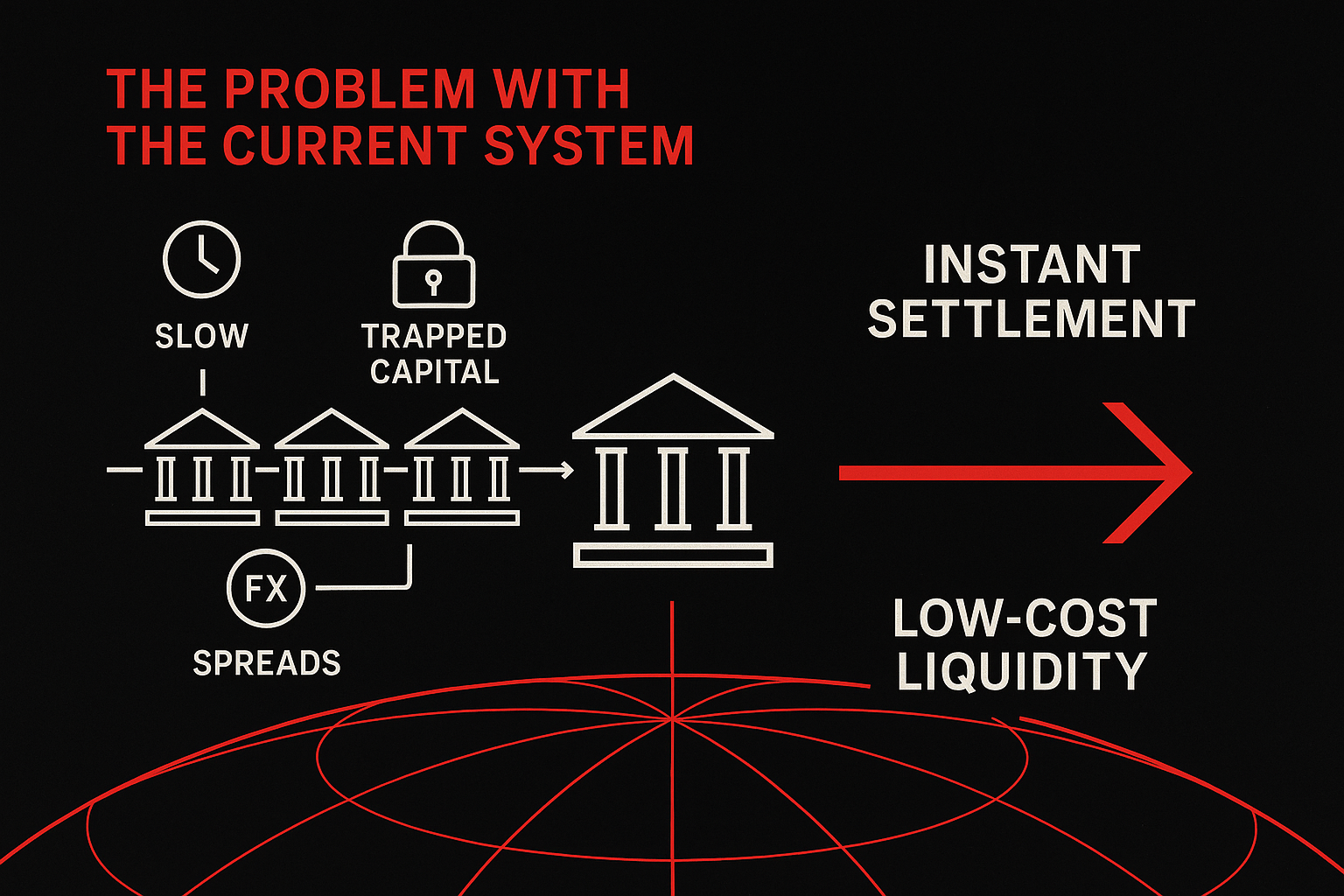

- The Problem with the Current System

Global finance runs on aging infrastructure.

Despite real-time communication, instant messaging, and same-day settlement in equity markets, cross-border payments still operate like it’s 1973.

Friction & Delays in Cross-Border Transfers

The legacy system relies on SWIFT messaging between correspondent banks — a network of trusted intermediaries that pass along payment instructions without actually settling funds.

- Settlement can take 3–5 business days

- Delays increase in emerging market corridors

- Time zone mismatches and manual interventions introduce failure points

Locked Capital in Nostro/Vostro Accounts

To facilitate payments globally, banks hold funds in nostro (our money in your bank) and vostro (your money in our bank) accounts across the world.

- Over $27 trillion is estimated to be locked in these accounts globally

- This capital earns little to no yield

- It creates trapped, inefficient liquidity that strains balance sheets

High Costs & Opacity

Fees associated with SWIFT and correspondent banking are not just high — they’re also unpredictable.

- Up to 7–10% of transaction value can be lost in smaller remittance corridors

- End-users are unaware of actual exchange rates or FX slippage

- Intermediaries often stack fees and inflate spreads

Lack of Interoperability

The current system is a patchwork of local ledgers — ACH, SEPA, CHAPS, Fedwire — with no universal standard.

- Cross-border interoperability is limited

- Transactions often fail due to mismatched formats, KYC issues, or unclear regulatory jurisdiction

- Real-time global clearing is impossible in this architecture

Bottom Line:

The current system is costly, slow, opaque, and ill-suited for a real-time global economy. The world needs infrastructure that is:

- Always-on

- Instant

- Interoperable

- Capital efficient

- Neutral and trusted

This is where XRP enters the frame — not as a speculative token, but as infrastructure built for the job.

- The Case for XRP

XRP was not designed to be a “crypto alternative to Bitcoin.”

It was architected to solve a specific, multi-trillion dollar problem: global value transfer.

From the very beginning, XRP focused not on decentralization as ideology — but on interoperability, liquidity efficiency, and instant settlement. It is, in many ways, digital infrastructure in native form — built for a financial world that still hasn’t caught up.

Designed for Speed, Scale, and Settlement

- Ledger Speed: Finality in 3–5 seconds

- Consensus Mechanism: Unique Node List (UNL) for agreement without mining

- Scalability: Handles ~1,500 transactions per second (TPS), scalable to 65,000+ TPS with sidechains

- Energy Use: Near-zero power consumption — no mining required

- Native DEX: Built-in decentralized exchange for trustless swaps, active since 2012

These features aren’t future promises — they are live, battle-tested, and currently supporting enterprise-grade flows.

XRP and On-Demand Liquidity (ODL)

One of XRP’s most transformational use cases is On-Demand Liquidity (ODL), developed by Ripple.

ODL replaces the need for pre-funded nostro/vostro accounts by using XRP as a bridge currency to facilitate real-time global settlement:Example:

A remittance company in Mexico needs to pay out USD → MXN.

Instead of holding USD in U.S. accounts, it:

- Buys XRP in the U.S.

- Sends XRP to a Mexican exchange

- Sells XRP for MXN→ Entire process takes seconds, not days — and no capital is trapped

Key benefits:

- Eliminates pre-funded accounts

- Frees up working capital

- Delivers payments in seconds, not days

- Mitigates FX volatility via instant conversion

Ripple has already partnered with hundreds of financial institutions globally using this model.

Neutral Infrastructure Layer

Unlike private stablecoins or CBDCs, XRP is:

- Open-source

- Neutral and borderless

- Not tied to a single government or institution

- Programmatic and interoperable with multiple assets

This allows XRP to serve as an unbiased bridge between currencies, platforms, and jurisdictions — something no state-backed coin can credibly offer at scale.

Key Takeaway:

XRP isn’t just a payment token. It is an integrated settlement layer, a liquidity bridge, and a trustless connector between fragmented value systems. It removes layers of inefficiency without reinventing the entire financial stack — and that makes it uniquely scalable.

- Regulatory Positioning

For a digital asset to become the backbone of financial infrastructure, it must be legally viable, globally interoperable, and institutionally adoptable. XRP has faced more regulatory scrutiny than nearly any other crypto asset — and now stands stronger for it.

The SEC v. Ripple Case: A Defining Moment

In December 2020, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, alleging XRP was sold as an unregistered security. The case rattled the industry — not because of XRP’s merits, but because of the chilling effect on institutional adoption in the U.S.

After nearly three years of litigation, the court delivered a historic ruling in July 2023:

“XRP, as a digital asset, is not in and of itself a security.”

– Judge Analisa Torres, U.S. District Court

Key outcomes:

- XRP programmatic sales (on exchanges) were deemed not securities

- Ripple’s institutional sales were partially deemed securities under specific conditions

- The ruling provided unprecedented legal clarity on XRP’s classification

This legal milestone positioned XRP as one of the only digital assets with partial court-backed regulatory clarity in the United States.

Global Compliance Strategy

Ripple didn’t just wait for the U.S. courts — it expanded globally during the legal battle:

- Ripple obtained licenses in key jurisdictions (e.g. Singapore’s MAS, UK FCA registration, EU VASP alignment)

- XRP is actively used in regulated corridors across Asia, LATAM, and EMEA

- Strategic headquarters and partnerships are distributed globally to insulate against U.S.-centric risk

Ripple also joined Digital Pound Foundation, Blockchain Australia, and US Faster Payments Council, reflecting its regulatory-first approach.

Why XRP Is Positioned as the Compliant Bridge Asset

Let’s be clear: most crypto assets have unclear legal status, particularly those built for speculative use or lacking real-world function.

XRP is different:

- Its use case is transactional, not investment-driven

- It has a long operational history with no known protocol-level hacks

- It now has judicial precedent recognizing its functionality and distinction from a security

- Ripple’s compliance-first expansion has created pathways for institutional usage

Compare this to anonymous teams, offshore foundations, and meme coins being delisted or targeted — and the contrast is stark.

Key implications:

- XRP is now being recognized as a strategic treasury reserve asset

- The move signals growing institutional confidence in XRP’s legal standing, liquidity depth, and long-term relevance

- It opens the door to more firms exploring XRP-denominated balance sheet allocations

This is infrastructure-level adoption — not speculative flows.

XRP has passed through the legal fire. And what emerged isn’t just a compliant asset — it’s a ready-made solution for institutions needing real-time liquidity and regulatory clarity. In a world where regulation determines survival, XRP is no longer in question. It’s in play.

- Liquidity Provisioning & Market Depth

At the heart of XRP’s utility lies a powerful but often misunderstood concept: liquidity provisioning.

If data is the new oil, liquidity is the new infrastructure — and XRP is designed to serve as the neutral liquidity between any two assets, anywhere in the world, at any time.

How XRP Functions as a Bridge Asset

XRP is uniquely qualified to bridge illiquid corridors where fiat pairs are sparse or expensive to convert directly. Instead of requiring a USD → NGN (Nigerian Naira) direct path, for instance, institutions can:

- Convert USD → XRP

- Transfer XRP across borders

- Convert XRP → NGN on the other side

This dramatically reduces slippage, eliminates FX intermediaries, and compresses settlement time to seconds.

Market Makers, Exchanges, and the Role of XRPL DEX

- The native decentralized exchange (DEX) on the XRP Ledger enables automatic order routing across pairs

- Liquidity providers (LPs) can post limit orders across any IOU or tokenized asset

- Upcoming AMM integration (automated market makers) will deepen on-ledger liquidity further

- The XRPL supports multi-hop routing — enabling complex trades (e.g., USD → EUR → XRP → MXN) in a single path

This is not theoretical. It’s operational.

Liquidity Depth Metrics & Adoption Trends

XRP has regained global liquidity strength following the SEC lawsuit resolution. Some metrics that underscore its infrastructure potential:

- Top 10 asset by global 24h trading volume, consistently over $500M–$1B/day

- Integrated into over 100 global exchanges, with fiat onramps in major jurisdictions

- Supported by leading liquidity providers and algorithmic market makers

- Institutional corridors live in Mexico, the Philippines, Brazil, the UAE, and Australia

In 2023–2025, XRP’s presence expanded across emerging market payment hubs, where liquidity is scarce and pre-funding is cost-prohibitive. These are the use cases that scale globally.

XRP as “Neutral Liquidity”

Most stablecoins are backed by a single issuer.

Most CBDCs are jurisdictionally bound.

Even ETH and BTC face friction when used as bridge assets due to congestion, volatility, and throughput.

XRP is:

- Neutral (not controlled by any nation or company)

- Fast (3–5 second settlement)

- Liquid (globally traded)

- Programmable (through Hooks, AMMs, and tokenized assets)

- Low-cost (fractions of a penny per transaction)

That’s the core value proposition — not just to retail investors, but to institutions, exchanges, treasuries, and entire central banks seeking efficient conversion mechanisms between otherwise illiquid currencies.

Key Takeaway:

XRP’s liquidity is not about hype or speculative pumps. It’s about utility — the ability to move value between any two parties, anywhere in the world, without intermediaries. As the digital asset economy matures, liquidity bridges like XRP will be indispensable.

- Comparative Advantage: XRP vs Alternatives

In the emerging financial stack, not all blockchains are created equal.

The question isn’t which coin will moon — it’s which asset can reliably serve as global financial infrastructure. XRP’s edge lies not in narrative, but in architecture, speed, cost, compliance, and purpose-built design.

Let’s compare XRP against major alternatives in key infrastructure domains:

XRP vs SWIFT (Legacy System)

Settlement Time

— XRP: 3–5 seconds

— SWIFT: 1–5 business days

Finality

— XRP: Near-instant

— SWIFT: Reversible, depends on counterparties

Capital Efficiency

— XRP: No pre-funding required

— SWIFT: Requires Nostro/Vostro accounts

Availability

— XRP: 24/7/365

— SWIFT: Business hours only

Transparency

— XRP: On-chain, auditable

— SWIFT: Opaque, multi-intermediary

FX Costs

— XRP: Fractions of a cent

— SWIFT: High, unpredictable

XRP modernizes SWIFT’s intent-based messaging into instant settlement rails, removing layers of friction and delay.

XRP vs Stellar (XLM)

Focus

— XRP: Institutional cross-border flows

— Stellar: Retail remittances, micro-payments

Adoption

— XRP: Used in enterprise corridors

— Stellar: Less adoption at scale

Liquidity Depth

— XRP: Higher, more active exchanges

— Stellar: Lower volume and fewer pairings

Compliance Strategy

— XRP: Ripple-led regulatory framework

— Stellar: Less structured regulatory infrastructure

Stellar and XRP share similar roots, but XRP has executed a more sophisticated strategy for institutional liquidity and legal clarity.

XRP vs Stablecoins (USDC, USDT, etc.)

Backing

— XRP: Native asset

— Stablecoins: Fiat reserves (custodial)

Issuer Risk

— XRP: None (open-source, decentralized)

— Stablecoins: High (centralized issuers like Tether/Circle)

Use as Bridge Asset

— XRP: Trustless, programmable

— Stablecoins: Requires issuer trust

Jurisdictional Limits

— XRP: None — operates globally

— Stablecoins: Subject to regulatory pressure and potential blacklisting

While stablecoins are excellent for value storage, they fall short as universal bridges due to custodial risk, jurisdictional exposure, and fragmentation.

XRP vs Algorand, Cardano, and Other L1s

Settlement Layer

— XRP: Live since 2012

— ALGO/ADA: Still developing or transitioning

Financial Use Case Focus

— XRP: Built specifically for payments and liquidity

— ALGO/ADA: Focused on smart contracts, governance, or general L1 functions

Global Payment Utility

— XRP: Primary mission

— ALGO/ADA: Secondary or unclear

Network Congestion

— XRP: Extremely low

— ALGO/ADA: Variable depending on network activity and architecture

Many L1s are promising smart contract platforms — but XRP’s focus remains laser-sharp on payments, liquidity, and interoperability.

XRP & Future-Proofing: Tech Stack and Quantum Resistance

- XRP’s consensus model doesn’t rely on mining or proof-of-work → significantly reduces risk exposure to quantum attacks on hash functions

- Ongoing research (Ripple + XRPL community) into post-quantum cryptography integrations

- Minimal smart contract surface area = reduced attack vector footprint

Key Takeaway:

XRP isn’t trying to do everything — and that’s exactly why it’s winning in its lane. As the world fragments into thousands of assets and chains, the need for a single, neutral, compliant bridge only grows stronger. XRP was built for that role — and it has no true competitor playing the same game at the same level.

This positions XRP as technically lean, secure, and adaptable to future threats without the overhead of bloated virtual machines.

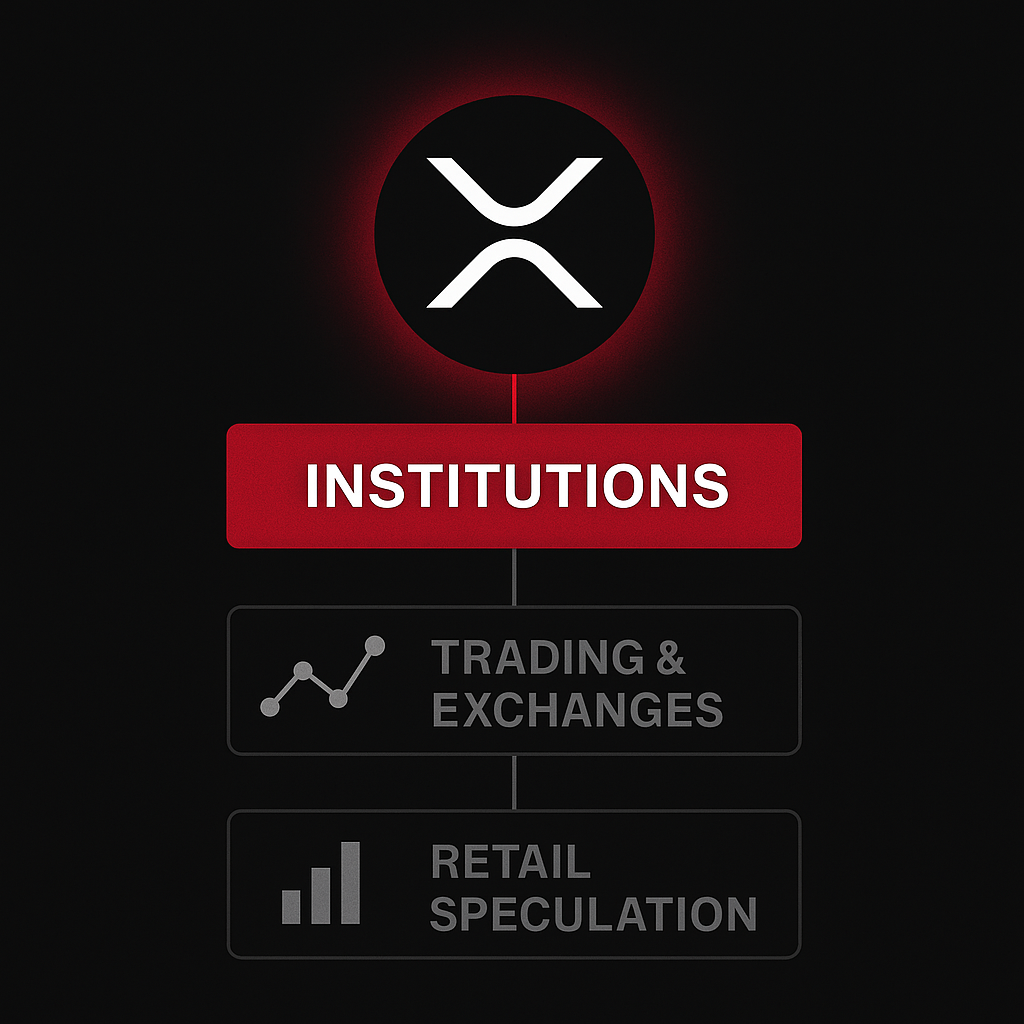

- Institutional Signals & Strategic Moves

XRP’s strength isn’t just technical — it’s strategic.

In a market bloated with roadmaps and vaporware, XRP is one of the few digital assets that’s not only live, but actively building institutional infrastructure and global rails behind the scenes.

Ripple’s Global Infrastructure Playbook

Ripple has quietly constructed one of the most expansive enterprise crypto infrastructures in the industry.

This includes:

- Global licensing: Registered with financial authorities in Singapore, the UK, and across the EU under MiCA provisions

- Partnerships with payment giants: SBI Holdings (ongoing), Tranglo, Pyypl, Novatti

- Corridors live in:

- Mexico 🇲🇽

- Philippines 🇵🇭

- Brazil 🇧🇷

- Australia 🇦🇺

- UAE 🇦🇪

- Thailand 🇹🇭

- India 🇮🇳 (via SBI/RippleNet)

These corridors are not experiments — they are live, with capital flowing and XRP acting as the liquidity bridge behind the scenes

Strategic Acquisitions by Ripple

Ripple is deliberately acquiring the critical infrastructure to support global, institutional-scale adoption of XRP:

- Metaco – Acquired in May 2023 for $250 million→ Institutional-grade custody platform trusted by banks and asset managers

- Standard Custody & Trust – Acquired June 2024→ A U.S.-regulated trust company enabling enterprise-level tokenization and Ripple’s stablecoin ambitions

- Hidden Road – Acquisition announced April 2025, valued at $1.25 billion→ A global prime brokerage firm, giving Ripple entry into institutional settlement and FX-grade liquidity provisioning for XRP

These moves give Ripple full-stack control of custody, issuance, liquidity, and brokerage — enabling it to position XRP as an institutional liquidity standard.

Treasury-Grade Recognition: Trident XRP Strategy

In mid-2025, Trident Digital Holdings launched a $500 million XRP Treasury Strategy — marking the first major institutional deployment of XRP for structured reserve management.

Why this matters:

- Moves XRP from a traded asset to a strategic reserve asset

- Signals that institutions no longer view XRP as a regulatory risk

- Opens the door for other hedge funds, family offices, and corporates to hold XRP on their balance sheets

This mirrors the 2020–21 Bitcoin Treasury movement — but with a completely different purpose: XRP is used, not just held.

XRPL Upgrades: Scaling for Institutional Use

Recent XRPL advancements reinforce XRP’s infrastructure potential:

- AMM integration – On-ledger liquidity pools for better spreads and routing

- Hooks – Lightweight smart contract logic at the protocol level

- Sidechains – Flexible smart contract environments for enterprises

- Native tokenization support – For real-world assets, stablecoins, and private issuers

These features allow regulated institutions to interact with tokenized value across borders — without changing infrastructure.

Key Takeaway:

XRP is not a meme coin, and Ripple is no longer a startup. The company is executing a coordinated strategy to own the stack — from custody to corridors to capital markets. With each acquisition and integration, XRP becomes more than a token — it becomes a requirement for settlement in the financial system that’s coming.

- Risks & Misconceptions

No investment thesis is complete without addressing what could go wrong — or what is commonly misunderstood.

In XRP’s case, much of the skepticism stems not from fundamentals, but from narrative baggage, ideological bias, or confusion rooted in history. Let’s separate myths from real risks, and ground our understanding in what actually matters.

Common Misconceptions About XRP

“XRP is centralized.”

This claim stems from Ripple’s early token allocation and prominent role in development.

Reality:

- The XRP Ledger is open-source and decentralized

- Ripple currently runs fewer than 5 of 130+ validator nodes

- Anyone can run a validator, and network participants can choose their own trusted node lists

- Governance decisions are not controlled by Ripple, and the validator ecosystem is growing in diversity

XRP’s architecture differs from proof-of-work or delegated staking — but that doesn’t make it centralized. In many ways, it’s more functionally decentralized than proof-of-stake chains controlled by whales.

“XRP is too volatile for finance.”

Reality:

- XRP is used as a transient bridge asset — held for seconds, not days

- Volatility is neutralized through real-time FX routing and conversion

- For institutions using XRP in On-Demand Liquidity (ODL), volatility exposure is lower than traditional pre-funded FX swaps

- As utility rises, volatility falls — speculation gives way to liquidity depth

The crypto market is volatile — but XRP’s role mitigates volatility by design, not amplifies it.

“XRP has no use case outside Ripple.”

Reality:

- The XRP Ledger has its own DEX, tokenization features, and open development ecosystem

- Projects like Evernode (smart contract platform), GateHub, Sologenic, and even carbon credit marketplaces are building on XRPL

- RippleNet customers aren’t required to use XRP — but many do

- XRP is not Ripple’s coin. Ripple is just one participant — albeit a major one — in a broader ecosystem

The ecosystem is expanding organically, with Ripple as an enabler — not a monopolist.

The Real Risks Investors Should Monitor

While the myths are overblown, XRP still carries risks worth taking seriously:

1. Regulatory Landscape Can Shift

Despite the U.S. legal clarity, global frameworks like MiCA, the UK’s FCA, and future Asian policies could tighten restrictions on bridge asset usage, tokenized settlements, or exchange operations.

Mitigation:

Ripple’s proactive licensing strategy and corridor diversification helps, but continued legal vigilance is required.

2. Competitive Encroachment

While XRP has first-mover advantage, stablecoins, CBDCs, and chains like Stellar, Polymesh, and even Circle/Chainlink collaborations could compete for specific liquidity segments.

Mitigation:

XRP must continue expanding corridors, upgrading protocol-level liquidity tools (e.g., AMMs), and incentivizing on-ledger FX activity to stay ahead.

3. Ecosystem Fragmentation

XRPL is under active development (Hooks, AMMs, sidechains), but developer mindshare and funding remain smaller than Ethereum, Solana, or Cosmos. This can limit organic growth and interoperability innovation.

Mitigation:

Grants, partnerships, and institutional integration must be paired with community growth and open-source developer support.

4. Market Misunderstanding

Despite its functionality, XRP remains widely misunderstood by both retail investors and traditional institutions. If narratives remain outdated, adoption could lag even as infrastructure is ready.

Mitigation:

Clear messaging, visible use cases, and educational positioning — like this report — are vital to closing the perception gap.

Key Takeaway:

XRP’s risks are real — but they are business risks, not existential ones. Misconceptions dominate public discourse, while the actual threats are manageable and strategic. For investors who understand the architecture and trajectory, XRP offers an unusually clarified and de-risked thesis relative to most of crypto.

- Forward Outlook

As the digital asset landscape matures, a clear divide is emerging between two types of tokens:

- Those built for narrative, hype, and retail speculation

- And those engineered for infrastructure, liquidity, and real-world integration

XRP belongs firmly in the second category.

It is not a “high beta crypto play” — it is a component of the next financial system.

Its upside is not just price-based — it’s structural, driven by function and adoption.

Adoption Runway Is Massive

Despite being operational for over a decade, XRP’s true utility is still early in deployment.

Consider:

- Over $150 trillion in cross-border payments occur annually — nearly all on slow, pre-funded rails

- Tokenized treasuries, bonds, and assets are growing rapidly — but still lack interoperable liquidity

- Most stablecoins and CBDCs are jurisdictionally siloed — creating demand for a neutral bridge asset

- XRP is one of the only assets that offers instant settlement, capital efficiency, and compliance flexibility

As the world tokenizes, it will need liquidity infrastructure more than it needs yet another programmable L1.

XRP’s Role in the Tokenized Economy

Financial institutions are already beginning to tokenize:

- BlackRock and Franklin Templeton are issuing tokenized funds

- JPMorgan, Visa, and Citi are piloting tokenized payment settlement

- Central banks are deploying CBDCs, which will eventually need interoperable corridors

In this world, XRP offers:

- A neutral bridge

- A fast, final settlement layer

- An always-on liquidity mechanism

As value fragments across ledgers, XRP is one of the few assets designed to connect, not compete.

Macro Tailwinds Are Building

- Post-regulatory institutional capital is unlocking

- Liquidity fragmentation is worsening — making efficient bridges more critical

- The global move away from U.S. dollar dependency creates demand for non-sovereign settlement tools

- The next bull cycle will likely be driven less by memes — and more by infrastructure adoption

Long-Term Price Implications

We don’t make short-term predictions — but we understand structure.

As XRP’s utility increases:

- Demand becomes use-case driven

- Circulating supply tightens (via treasury holdings, corridor liquidity requirements)

- Institutional positioning increases

- And price must eventually reflect its centrality in global value movement

If even 1–3% of cross-border FX volume is routed through XRP, the repricing will be unavoidable. The market simply hasn’t modeled that in — yet.

Final Thought:

Most investors are chasing price action.

Bayberry Capital is chasing infrastructure — and value that flows through it.

XRP is not a speculative bet. It’s a structural thesis.

It is one of the few assets that will matter more in the future than it does today — not because of hype, but because of utility, liquidity, and inevitability.

The longer the world ignores XRP, the larger the asymmetry becomes.