XRP vs Ethereum: The Battle for #2

By Bayberry Capital

Introduction

For over a decade, crypto markets have rewarded speculation. Ethereum captured liquidity with DeFi and culture. XRP, meanwhile, carried the weight of regulatory battles.

But the rails of the next financial era will not be chosen by speculation. They will be chosen by utility — speed, cost, and reliability at scale.

Ethereum dominates speculative liquidity. The XRP Ledger (XRPL) is engineered for utility liquidity. That is the real contest for the #2 spot.

Settlement & Finality

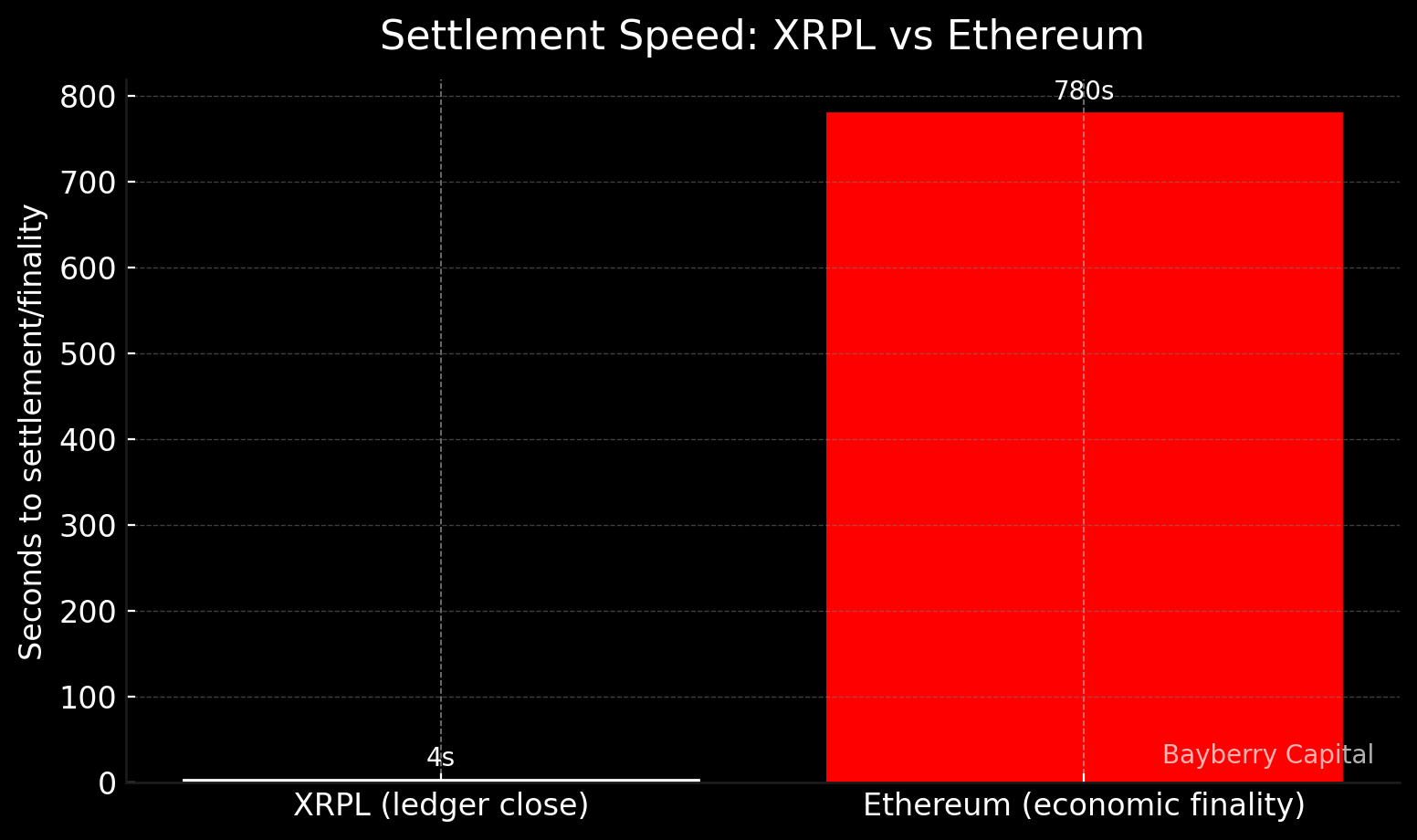

XRPL: 3–5 second ledger closes, deterministic finality.

Ethereum: ≈13 minutes for economic finality on L1. Rollups shorten the experience but settlement ultimately traces back to L1.

For DeFi churn, minutes don’t matter. For payments and FX, seconds vs minutes is not the same product.

Cost & Scalability

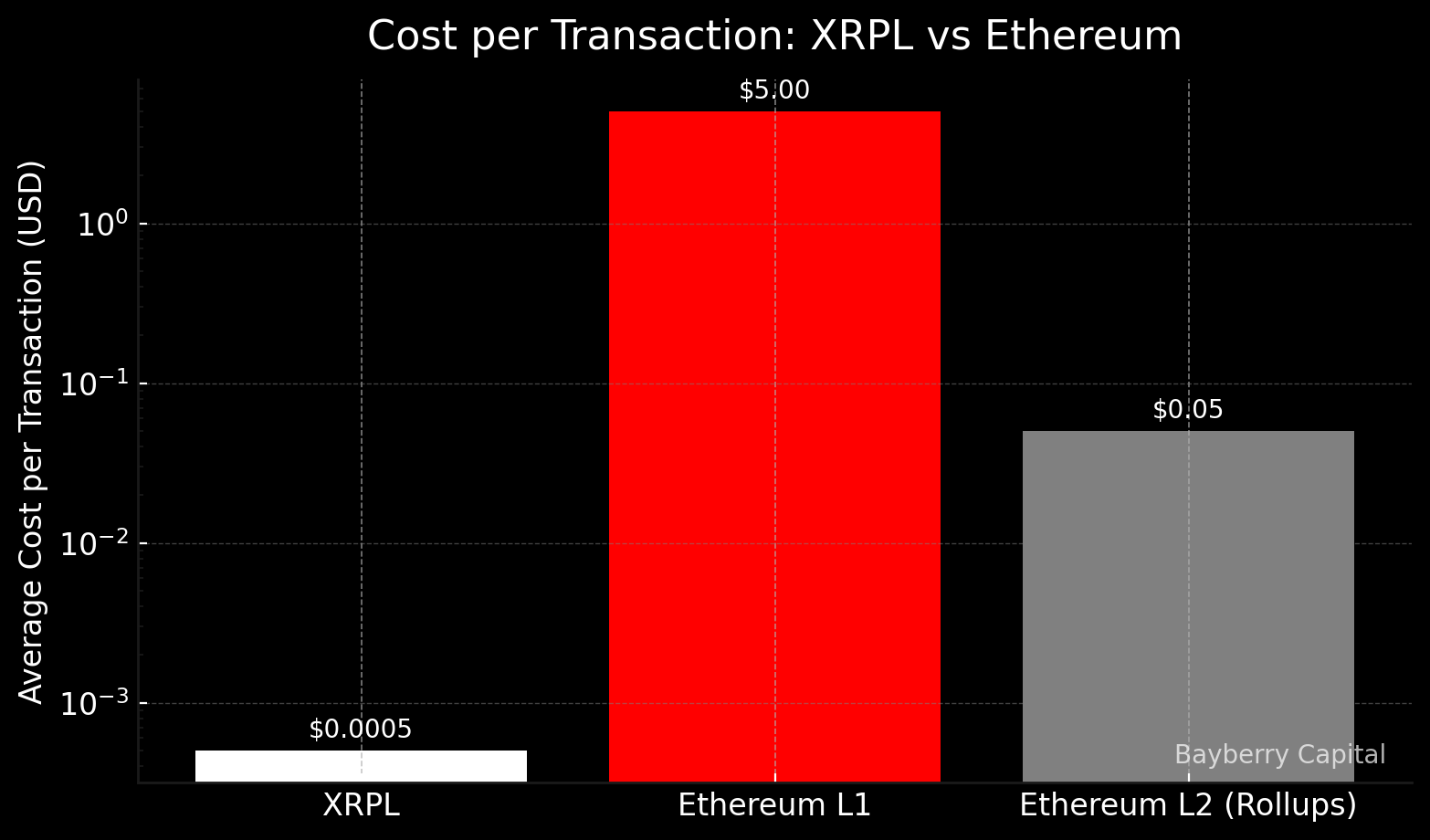

XRPL: Fractions of a penny, predictable, stable.

Ethereum: Gas fees fluctuate with demand. Rollups cut costs but add fragmentation and risk.

Institutions require cost predictability. XRPL provides it.

Liquidity Architecture

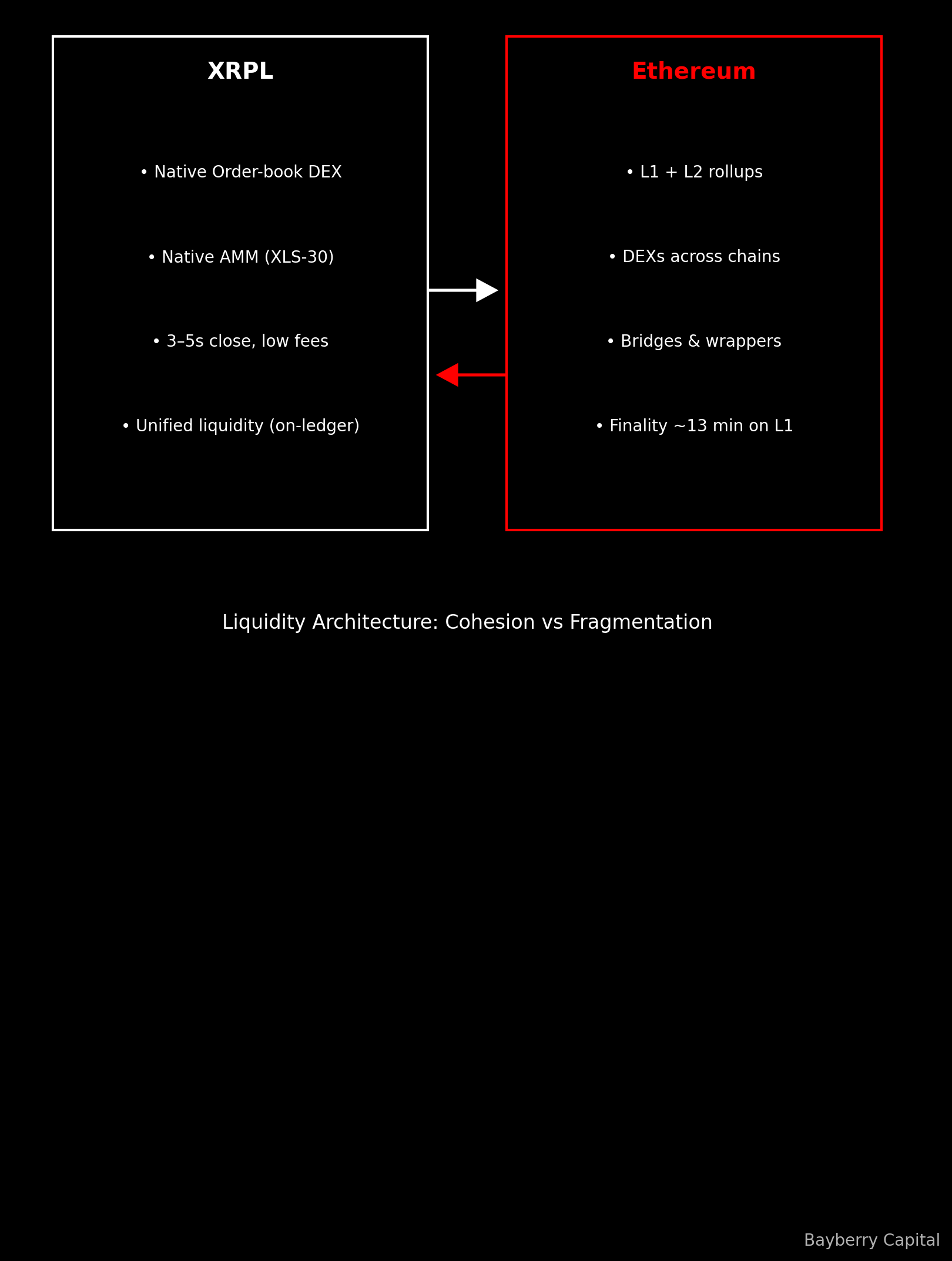

XRPL: Native order-book DEX and protocol-level AMM (XLS-30). Unified liquidity on-ledger.

Ethereum: Deep but scattered across L1, L2s, and bridges. Efficient for experimentation, less so for cohesive settlement.

One system is cohesive by design. The other is fragmented by necessity.

Market Cap History

Dec 31, 2017: XRP ($89.1B) > ETH ($73.2B). XRP briefly claimed the #2 market cap.

Aug 31, 2025: ETH ($529.9B) > XRP ($165.2B). ETH holds the position, but the race continues.

History shows the gap can close... and flip.

Institutional Readiness

Ripple has already productized XRPL liquidity through Ripple Payments (formerly ODL). Corridors actively use XRP as a bridge asset today.

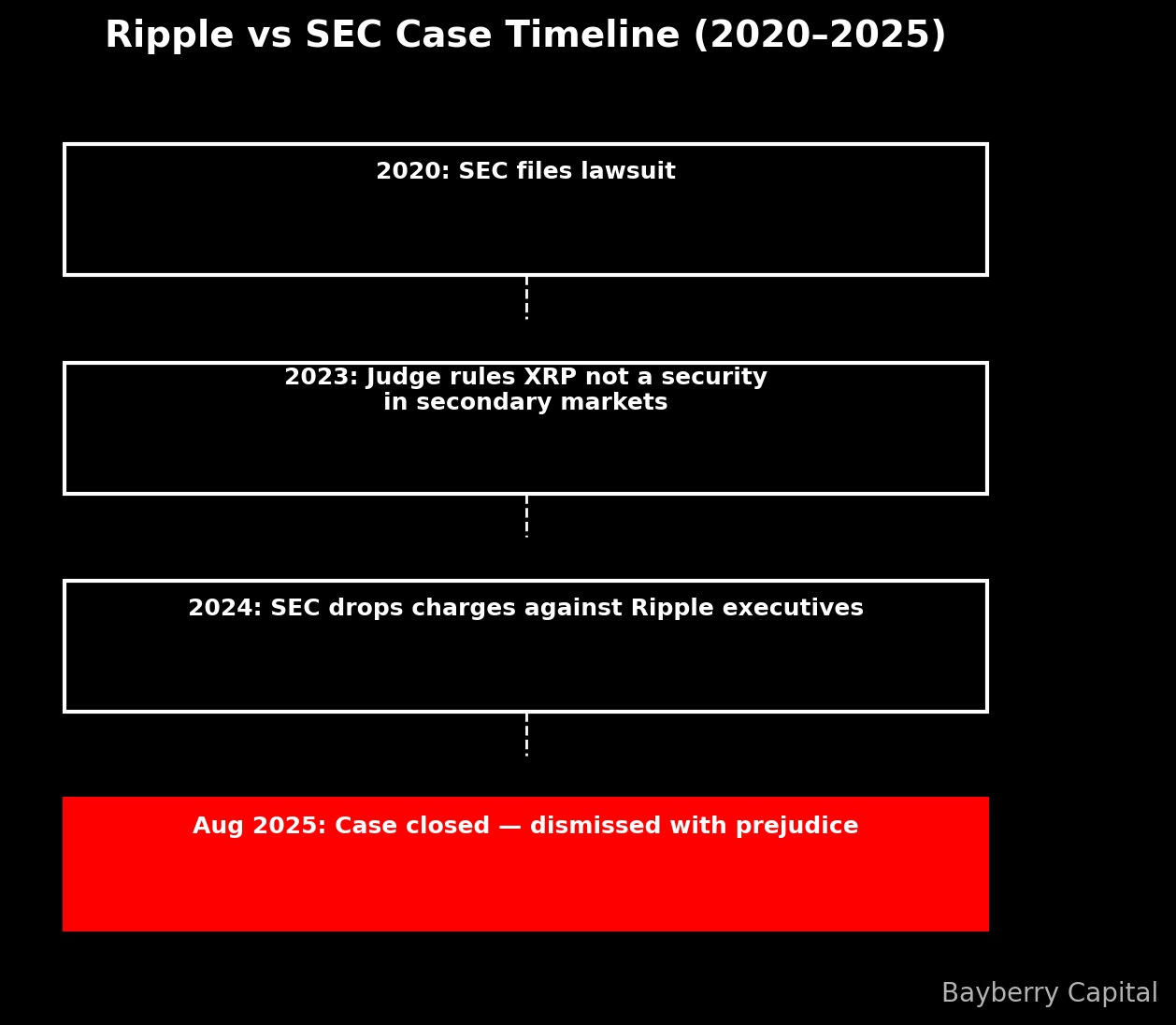

With the SEC case formally closed in August 2025, the regulatory overhang is gone. Enterprises now have clarity to build.

Stablecoin + Interoperability

- Ripple’s RLUSD stablecoin launched on XRPL and Ethereum, anchoring fiat liquidity while tapping into EVM venues.

- The XRPL EVM sidechain (mainnet June 30, 2025) allows Ethereum-compatible smart contracts on XRPL’s fast, low-cost settlement.

This is not isolation. It is strategic interoperability.

Regulatory Timeline

2020: SEC files lawsuit

2023: Judge rules XRP not a security in secondary markets

2024: SEC drops charges against Ripple executives

Aug 2025: Case closed , dismissed with prejudice

Why This Matters

Ethereum will continue leading speculative DeFi. But speculation is not adoption.

The next growth phase is stablecoin settlement, tokenized assets, and payments. That requires rails built for certainty, speed, and compliance.

The XRPL is already standing at that intersection.

Conclusion

Ethereum remains the culture hub of DeFi. But the XRP Ledger is primed to be the infrastructure hub of global settlement.

The #2 race is not about narrative. It is about function. And when markets shift from speculation to adoption, utility always wins.